Table of Contents

ToggleData Centre Land Investment India: Why Smart Money is Moving Beyond Traditional Real Estate

Part 1: While everyone chases AI stocks, smart money is buying the land underneath India’s digital future

Data Centre Land Investment India – It represents the most significant infrastructure opportunity since the IT boom. Last Tuesday, I received three calls within an hour. All from different real estate consultants. All asking the same question: “Do you know any landowners near Navi Mumbai who might sell 50+ acres?” They weren’t building housing projects. They weren’t planning shopping malls. They were hunting for data centre land.

This represents the next major shift in Indian real estate – building on the “10 fundamental changes” I documented that made land the core asset of 2025, but with AI and digitisation as the new growth drivers.

Here’s what triggered those calls: India’s data centre industry just announced it needs 10 million square feet of new real estate by 2026, backed by $5.7 billion in fresh investment. But here’s the part that makes my 25 years of land investment experience tingle with opportunity: this isn’t just about any land. It’s about particular types of land in precise locations.

As the ‘Green Man’ who has spent two and a half decades analysing where India’s infrastructure money flows, I can tell you: we’re witnessing the birth of a new asset class. Data centre land isn’t just real estate—it’s the foundation of India’s digital economy.

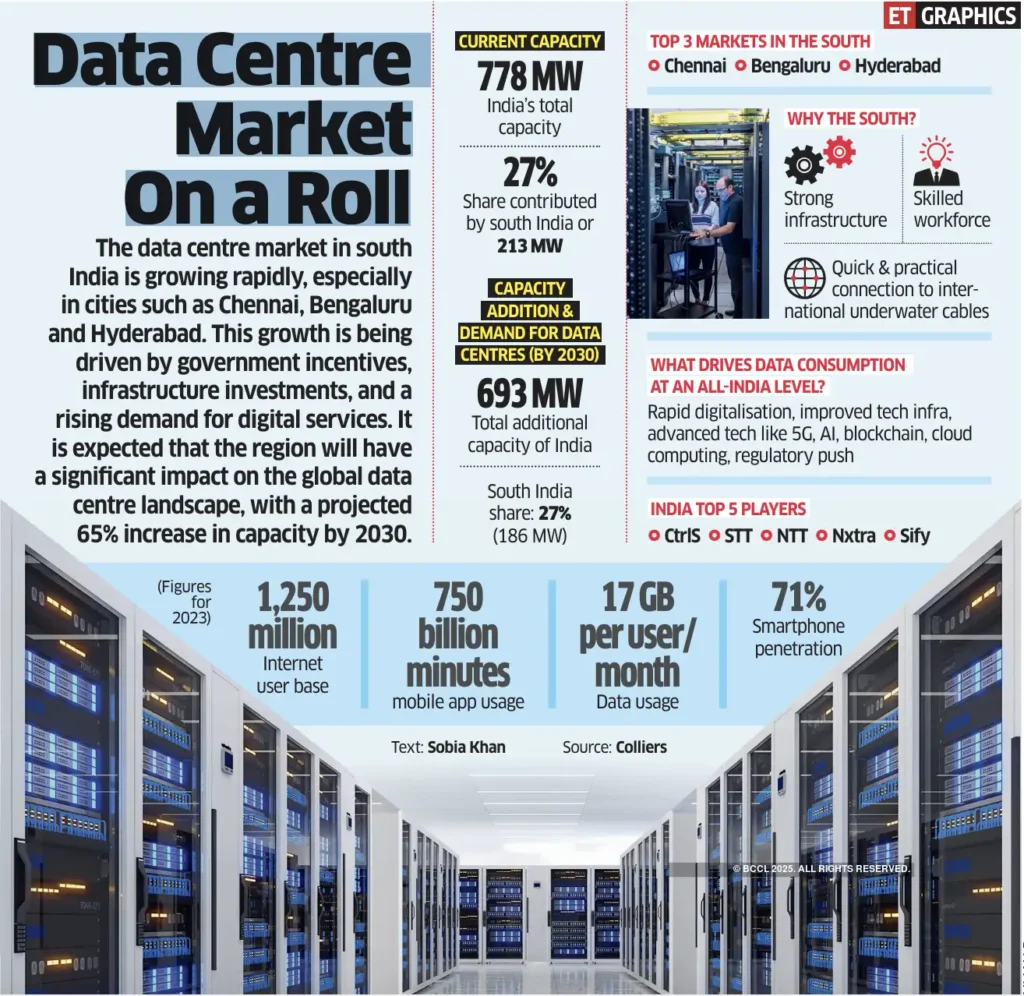

The Numbers That Will Shock You -The scale of data centre land investment in India becomes clear when we examine these projections

The data centre land investment in the Indian market is experiencing unprecedented growth. The scale of India’s data centre expansion defies imagination. Current capacity stands at 1,263 MW across the country as of April 2025. By 2030, this will explode to over 4,500 MW—nearly a fourfold increase in just five years.

To put this growth in perspective, consider what each megawatt represents. Every MW of data centre capacity requires approximately 0.5 to 1.5 acres of land, depending on the facility design and cooling requirements. With over 3,200 MW of new capacity coming online by 2030, we’re looking at 1,600 to 4,800 acres of prime industrial land across India’s major metropolitan areas.

However, here are the numbers that will make seasoned investors take notice: Mumbai alone is expected to add 1,000-1,200 MW of capacity by 2030. That’s roughly 1,500-2,000 acres of prime industrial land in a city where good industrial plots sell for ₹5-15 crore per acre. We’re talking about a ₹15,000-30,000 crore land market in Mumbai alone.

Chennai, currently holding 23% of India’s data centre capacity, is projected to become the second-largest market by 2030. The city will need approximately 2.89 million square feet of new real estate space in the next three years. At current industrial land prices of ₹3-8 crore per acre, this represents a ₹10,000-15,000 crore opportunity in the Chennai corridor.

The investment requirements are equally staggering. The industry has already attracted ₹1,25,000 crore ($14.63 billion)in committed investments since 2020. An additional ₹1,70,840-2,13,550 crore ($20-25 billion) is expected by 2030. Of this massive investment, approximately 20-25% is allocated to land acquisition and site development.

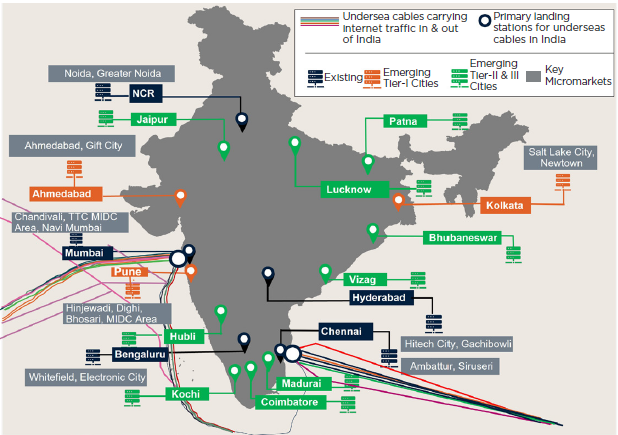

Here’s what most investors don’t understand: data centres can’t just be set up anywhere. They need a guaranteed 24/7 power supply, fibre connectivity, flood-free zones, and proximity to submarine cable landing stations. This combination is found in approximately 15-20 locations across India. Scarcity drives value, and we’re witnessing artificial scarcity created by technical requirements.

Why Data Centre Land Investment is Different

Traditional real estate follows predictable patterns—location, connectivity, and demographics drive value. Data centre land operates by entirely different rules.

The concept of “powered land” has emerged as the new gold standard. Regular industrial land in metros sells for ₹2-5 crore per acre. Powered land with utility commitments commands ₹8-15 crore per acre. But data centre-ready land—with power, connectivity, cooling infrastructure, and regulatory approvals—can fetch ₹15-25 crore per acre in prime locations.

Consider the transformation happening in Navi Mumbai. Google has committed ₹1,144 crore for an 8-storey, 381,000 sq ft data centre. Microsoft is building alongside. CtrlS Datacenters is constructing a 2 million sq ft hyperscale facility in the same region. Land prices in optimal corridors have tripled in 18 months.

The power requirements alone create a new investment category. Modern data centres consume 2-50 MW of power—equivalent to a small city. States offering guaranteed power supply at competitive rates are seeing land values appreciate 40-60% annually. Karnataka’s power surplus positioning has made the Bangalore corridors particularly attractive, with land prices rising from ₹ two crore to ₹6-8 crore per acre.

But here’s the strategic insight from my quarter-century of infrastructure investing: data centres create ecosystem effects. Every major data centre attracts supporting industries—component manufacturers, cooling system suppliers, backup power providers, and housing for a high-skilled workforce. The adjacent land appreciates through multiple cycles.

Unlike residential or commercial real estate, data centre land investment offers three distinct value drivers: immediate land appreciation, long-term lease potential, and ecosystem development benefits. This triple-layer return mechanism is rare in traditional real estate categories.

Data Centre Land Investment India: Geographic Hotspots

Understanding data centre land investment in India requires analysing these strategic corridors. The geography of data centres follows digital infrastructure, not traditional economic centres. The success of data centre land investment in India depends on understanding these strategic geographic corridors.

Mumbai: The Digital Gateway

Mumbai dominates with 41% of India’s current data centre capacity, and for good reasons. The city hosts 10 submarine cable landing stations, making it India’s gateway to global internet traffic. Every byte of data flowing between India and the world likely passes through Mumbai’s data centres.

The Western Express Highway corridor, from Andheri to Navi Mumbai, has emerged as India’s Silicon Valley of data storage. Land prices have jumped from ₹8-12 crore per acre in 2023 to ₹18-25 crore per acre in 2025. Yet, with Mumbai needing 1,000+ MW of additional capacity, the appreciation cycle is just beginning.

Key investment corridors include:

- Navi Mumbai MIDC: Google, CtrlS, Microsoft projects driving demand. Recent announcements from Google’s India expansion and Microsoft’s Azure data centre investments validate this corridor’s potential.

- Taloja-Panvel Belt: Emerging as a hyperscale hub with better power availability

- Rabale-Mahape Corridor: Fibre connectivity and IT ecosystem synergy

Chennai: The Southern Powerhouse

Chennai holds 23% of India’s data centre market, boasting a unique advantage: access to submarine cables and renewable energy. The city connects India to Southeast Asia, making it crucial for regional data flow.

The state’s submarine cable connectivity, as mapped by Submarine Cable Networks, positions Chennai as India’s digital gateway to Southeast Asia.

Tamil Nadu’s renewable energy surplus, combining wind and solar, positions Chennai perfectly for ESG-conscious data centre investments. Green-certified data centres command a 15-20% premium in lease rates, translating to higher land values.

Investment opportunities include:

- Chennai-Bangalore Highway (NH-48): Industrial corridor with power infrastructure

- Sriperumbudur-Oragadam Belt: IT SEZ proximity creating synergies

- Mamallapuram Coast: Future submarine cable landing potential

Hyderabad: The Dark Horse

Hyderabad is emerging as India’s data centre surprise story. With established IT infrastructure, competitive power costs, and supportive state policies, the city is projected to add 1,000-1,200 MW by 2030—rivalling Mumbai’s expansion.

Telangana’s aggressive data centre policy offers:

- Single-window clearances reduce setup time by 6-12 months

- Power cost subsidies of up to 25% for large installations

- Land at Industrial Development Corporation rates

Land investment opportunity

Current prices of ₹2-5 crore per acre offer exceptional value compared to other metros.

The Tier-2 Wave

Edge computing and the rollout of 5G are pushing data centres into Tier 2 cities. Pune added 15 MW in H2 2024, with commitments from cloud service providers. Kolkata saw a fresh supply addition after years of stagnation, with 195 acres earmarked for data centre development.

The investment thesis for Tier-2 cities centres on cost arbitrage and latency requirements. As applications demand sub-millisecond response times, data centres must move closer to users—cities like Jaipur, Indore, and Coimbatore, with improving connectivity infrastructure, present early-stage opportunities.

Three Data Centre Land Investment India Strategies

Each data centre land investment strategy in India offers a different risk-reward profile. Global trends show similar patterns in mature markets, such as Singapore and Hong Kong.

Based on my analysis of data centre land investment patterns in India and infrastructure mega-trends over the past 25 years, I have identified three distinct investment strategies emerging in the data centre landscape.

Strategy 1: The Direct Land Play

This involves purchasing large industrial plots (20-100 acres) in identified data centre corridors before major announcements. The key is understanding power grid expansion plans and submarine cable routes before they become public knowledge.

Target Locations:

- NH-8 corridor between Gurgaon and Neemrana

- Mumbai-Pune industrial belt, especially around Lonavala-Talegaon

- Chennai-Bangalore highway between Sriperumbudur and Hosur

- Hyderabad outer ring road industrial nodes

Investment Horizon: 3-7 years for maximum appreciation as infrastructure develops and hyperscale players make commitments.

Risk Level: Medium, primarily dependent on state power policies and infrastructure delivery timelines.

Expected Returns: 25-40% annually during the development phase, stabilising at 15-20% as the market matures.

Strategy 2: The Adjacency Opportunity

This strategy involves purchasing residential or mixed-use development land within 5-15 km radius of confirmed data center projects. Data centres bring high-paying jobs, infrastructure upgrades, and economic activity that benefits surrounding areas.

The logic is simple: every 50 MW data centre employs 200-500 people directly and creates 1,000-2,000 indirect jobs. These are typically high-skilled, well-paid positions that drive demand for quality housing, retail, and services.

Implementation Approach:

- Identify confirmed data centre projects above 25 MW capacity

- Map a 10-km radius for residential development potential

- Focus on areas with existing road connectivity but underdeveloped real estate

- Target plots suitable for integrated townships or gated communities

Investment Horizon: 5-10 years for township development and full value realisation.

Expected Returns: 20-30% annually as the ecosystem develops, with additional rental yield potential.

Strategy 3: Green Data Center Land Specialization

This builds directly on insights from my analysis of Collaborative Managed Farmland in India, where sustainability meets superior returns through strategic positioning and shared expertise. This is where my environmental advocacy meets an investment opportunity. The future of data centres is green, and land with access to renewable energy will command premium valuations.

Data centres consume enormous amounts of electricity—a 50 MW facility uses as much power as 37,500 homes. Corporate ESG mandates are pushing hyperscale operators toward renewable energy. By 2030, 40% of Indian data centres will be green-certified, creating a premium market for sustainable locations.

Target Characteristics:

- Proximity to solar farms or wind installations

- State renewable energy policies supporting long-term contracts

- Water availability for sustainable cooling systems

- Carbon credit generation potential

Premium Locations:

- Gujarat solar corridors with data connectivity

- Tamil Nadu wind-rich areas near Chennai

- Karnataka’s renewable energy surplus regions

- Rajasthan solar zones with improved connectivity

Investment Thesis

Green-certified data centres command 15-25% premium in lease rates and attract ESG-focused international investment. Land supporting such developments will see corresponding value appreciation.

Government Policy: The Hidden Catalyst

Policy support for data centre land investment in India comes from both the central and state governments.

When governments start subsidising land for an industry, savvy investors pay attention. This isn’t just policy support—it’s policy-driven land value creation happening across multiple states simultaneously. The coordinated policy support for digital infrastructure, combined with the economic reforms I outlined in GST Reforms 2025, creates unprecedented tailwinds for data centre land investment.

The Ministry of Electronics and IT’s National Data Governance Framework provides the regulatory foundation for this growth. Uttar Pradesh’s comprehensive policy document outlines the specific incentives driving land value appreciation. The central government’s recognition of infrastructure status enables long-term financing that was previously unavailable to data centre developers.

The central government’s decision to accord “infrastructure status” to data centres enables access to long-term financing at competitive rates. But the real action is at the state level, where aggressive incentive packages are creating immediate land value appreciation.

Uttar Pradesh leads with capital subsidies of up to 7%, interest subsidies of up to 60%, and land subsidies ranging from 25% to 50%. Industrial land in Greater Noida has appreciated 30-40% since the policy announcement.

Telangana offers land at Industrial Development Corporation rates (40-50% below market), 25% power cost subsidies, and single-window clearances. Hyderabad land prices have risen from ₹2 crore to ₹6-8 crore per acre in optimal corridors.

Maharashtra offers stamp duty exemptions for transactions exceeding ₹100 crore and provides fast-track approvals, thereby maintaining Mumbai’s market leadership while opening up new opportunities in Pune and Aurangabad.

This policy competition between states creates arbitrage opportunities for informed investors. Early positioning in policy-supported corridors, before infrastructure development and corporate announcements, offers exceptional return potential.

What’s Next: The Risk Reality Check

The data centre land opportunity is massive, but it’s not without risks. Power grid constraints, regulatory changes, technology disruptions, and environmental challenges could impact specific markets or investment strategies.

Understanding these risks—and how to mitigate them—is crucial for successful data centre land investment. The due diligence requirements, timeline considerations, and exit strategies differ significantly from traditional real estate investments.

The wealth creation patterns I’ve documented – from Collaborative Managed Farmland to the 10 Shifts in Indian Real Estate and major corporate land acquisition strategies – all point to the same conclusion: strategic land investment in emerging infrastructure sectors offers the highest risk-adjusted returns available today.

The data centre land investment opportunity window in India is narrowing as institutional awareness grows. In Part 2 of this analysis (publishing Monday, 29th September, 2025), I’ll dive deep into:

- Complete risk assessment and mitigation strategies

- Environmental opportunities and the green data centre premium

- Detailed government policy analysis across all central states

- Your step-by-step action plan for entering this market

- Due diligence checklist covering power, connectivity, and regulatory compliance

- Timeline and exit strategies for different investment approaches

The opportunity window is narrowing as mainstream awareness grows.

First-mover advantage belongs to those who understand both the opportunity and the risks.

Take Action Today

Ready to explore data centre land opportunities before Part 2? I’m available for strategic consultation calls to discuss your specific investment goals and risk appetite based on 25 years of infrastructure trend analysis.

Schedule Your Strategy Session

Don’t miss Part 2 of this analysis: Join the founding members of “Land Intel by KDR” and get Monday’s risk analysis and action plan delivered directly to your inbox, plus exclusive quarterly strategy calls.

Need the complete due diligence framework? Download my free “Data Centre Land Investment Checklist” – the 47-point verification guide I use for evaluating ₹50+ crore opportunities.

Connect and get a free Checklist.

Kushal Dev Rathi, known as the ‘Green Man’ of Indian land investment, combines 25 years of real estate expertise with environmental sustainability advocacy. His insights on infrastructure mega-trends have guided over ₹500 crore in successful acquisitions.