The Silent Wealth Shift: From Screens to Soil – Insights by Kushal Dev Rathi

Over the last 25 years, I’ve seen how India’s wealthy approach investment decisions. While trends come and go, one thing is becoming increasingly clear:

In today’s volatile world, land is emerging as the most powerful wealth strategy—and the next billionaires are already betting on it.

As equity markets wobble, tech valuations flatten, and digital fatigue rises, serious investors are asking a new question:

“How much of my wealth is floating—and how much is grounded?”

Why Kushal Dev Rathi Believes Strategic Land Acquisition Beats Equity

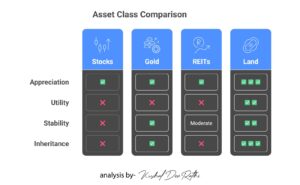

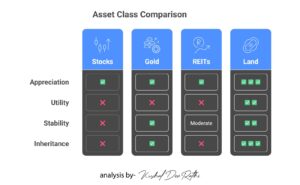

Here’s what land offers that stocks, mutual funds, and crypto don’t:

- Tangible Control: Land doesn’t disappear in a crash or a tweet.

- No Depreciation: Land never gets old, broken, or outdated.

- Legacy-Friendly: Land can be passed down—without dilution or dematerialization.

- Multi-Utility: Agriculture, tourism, rentals, conservation—it’s a multi-channel asset.

And most importantly:

Land in India is appreciating faster than most urban real estate or equity instruments when selected strategically.

Real Examples: Land Value Growth in High-ROI Zones

These are not predictions—they’re verified outcomes:

✅ Noida International Airport Belt

- ✅ 300% land value growth since 2012

- ✅ Driven by Yamuna Expressway, DMIC, and global cargo infrastructure

✅ Sariska–Alwar Wellness Corridor

- ✅ 4X appreciation since 2015

- ✅ Eco-tourism, forest zoning, solar corridor expansion

✅ Goa–Maharashtra Coastal Border

- ✅ 2.5X increase in last 3 years

- ✅ Triggered by NH166S, CRZ reform, second-home buyers

These weren’t random wins. They were strategic forecasts made before infrastructure made the news.

The Kushal Dev Rathi Framework: Land as Wealth Infrastructure

“I don’t chase markets. I anticipate them.”

My work with investors, family offices, and green micro-communities has centered around one belief:

Land is not inventory. It’s insight.

Kushal Dev Rathi’s Land vs REITs Comparison

Here’s how we approach it:

- 🔍 Identify undervalued micro-corridors before the wave

- 🧠 Use policy, zoning, and ecological factors as signals

- 💡 Build legacy-based frameworks—not trend-driven decisions

- 🌱 Enable yield (agriculture, tourism, carbon credits), not just price appreciation

Final Thought

- In a world that celebrates fast wealth, I believe in slow capital that grows deep roots.

- You can measure your value in hours.

Or in acres that endure across generations.

CTA Block:

- 📬 Want deeper insights on land strategy, location foresight, and building generational wealth?

Subscribe to the Land Wealth Letters – India’s first soil-first strategy newsletter by Kushal Dev Rathi.

🔗 Read Newsletter on Substack, Medium and Linkedin

🌐 Explore More on kushaldevrathi.com

Also read :

-->

class="post-3789 post type-post status-publish format-standard has-post-thumbnail hentry category-investment category-land-investment tag-farmland-investment-strategy tag-gated-agri-communities tag-generational-wealth tag-high-roi-assets tag-indias-next-billionaires tag-kushal-dev-rathi tag-land-as-wealth tag-land-banking-india tag-land-investment-india tag-land-value-appreciation tag-land-vs-equity tag-land-vs-reits tag-real-asset-class tag-real-estate-trends-india tag-strategic-asset-allocation tag-tangible-investments tag-urban-farming-india tag-wealth-preservation-assets tag-wealth-strategist-india ast-grid-common-col ast-full-width ast-article-post" id="post-3789" itemtype="https://schema.org/CreativeWork" itemscope="itemscope">

-->

class="post-3667 post type-post status-publish format-standard has-post-thumbnail hentry category-nature ast-grid-common-col ast-full-width ast-article-post" id="post-3667" itemtype="https://schema.org/CreativeWork" itemscope="itemscope">

-->

class="post-3653 post type-post status-publish format-standard has-post-thumbnail hentry category-nature tag-breathing-easier-how-monsoon-improves-air tag-soil ast-grid-common-col ast-full-width ast-article-post" id="post-3653" itemtype="https://schema.org/CreativeWork" itemscope="itemscope">

One algorithm changed global industries overnight. But at my urban farm? Growth remained steady, digitally precise, and powerfully predictable.

Last week marked World Youth Skills Day, centered around the powerful theme, “Youth empowerment through AI and digital skills.” While global headlines buzzed about tech layoffs and economic uncertainties, I watched a young intern at our urban farm quietly recalibrating a drone for optimal irrigation.

And there it was, vividly clear: Skills aren’t just learned, they are investments.

India houses the world’s largest youth population over 356 million individuals aged 10-24. Yet, according to UNICEF, nearly half lack adequate digital skills required for future employment. That’s not just a challenge; it’s a critical investment gap.

Globally, AI-driven economies are projected to add $15.7 trillion by 2030, according to PwC. In India alone, investments in AI and digital startups surged to $1.7 billion in 2023. While headlines may worry about technology displacing jobs, the World Economic Forum confidently states that AI will generate 97 million new jobs by 2025, significantly outweighing the 85 million jobs potentially displaced.

At our urban farms, digital tools and AI technology aren’t just innovations, they’re essentials. Our precision irrigation system, driven by AI, reduces water use by up to 90% compared to conventional methods. Machine learning tools track soil health, boosting crop yield by over 30% consistently.

One young team member recently utilized AI to optimize plant growth schedules, enhancing our productivity by 35%. Another developed a mobile app, transforming urban gardening into a widespread community activity.

Amid global digital volatility, one thing is evident: true stability comes from nurturing human skill and potential.

As investors, leaders, and mentors, our real ROI is ensuring youth are digitally empowered. This isn’t just about employment, it’s about sustainable survival and enduring prosperity.

In a fast-paced, unpredictable world, investing in youth AI skills isn’t just smart—it’s necessary.

Because future growth, quite literally, depends on it.

-->

class="post-3645 post type-post status-publish format-standard has-post-thumbnail hentry category-lifestyle category-nature ast-grid-common-col ast-full-width ast-article-post" id="post-3645" itemtype="https://schema.org/CreativeWork" itemscope="itemscope">

When we think of luxury, images of exclusive mansions, opulent lifestyles, and premium amenities immediately spring to mind. But today, a profound transformation is underway: Luxury now also means responsibility luxury intertwined seamlessly with sustainability.

India’s affluent, driven by both personal values and market foresight, are increasingly integrating sustainable practices into their luxurious lifestyles. According to Knight Frank’s latest Wealth Report, over 70% of ultra-high-net-worth individuals in India see sustainable investing as integral to their portfolio strategies.

Urban farming is at the heart of this transformation. Picture a sophisticated rooftop farm overlooking a bustling city skyline, employing AI-driven hydroponics systems that reduce water usage by up to 90%, or luxury residences seamlessly integrating organic farming into architectural designs. These aren’t mere concepts, they are active realities reshaping modern urban living.

Studies reveal properties featuring sustainable urban farming amenities see their valuation enhanced by as much as 15-20%. This isn’t merely about aesthetics or novelty; it’s about strategic investment and forward-thinking vision.

Urban farming luxury isn’t just sustainable, it’s strategic. Smart technology monitors crop health, enhancing productivity, reducing costs, and even purifying air quality. For India’s elite, investing in urban sustainability is a clear demonstration of foresight, sophistication, and responsibility.

One influential business leader recently shared with me, “Sustainability isn’t a trend, it’s a necessity. And now, luxury that doesn’t account for sustainability is outdated.”

In the emerging narrative of luxury, the true symbol of status isn’t excess, it’s sustainable abundance. Urban luxury now means living in harmony with the environment, demonstrating that wealth and ecological responsibility can coexist beautifully.

Ultimately, true luxury today is not just about possessing it’s about preserving.

-->

class="post-3639 post type-post status-publish format-standard has-post-thumbnail hentry category-nature category-lifestyle ast-grid-common-col ast-full-width ast-article-post" id="post-3639" itemtype="https://schema.org/CreativeWork" itemscope="itemscope">

-->

class="post-3679 post type-post status-publish format-standard has-post-thumbnail hentry category-nature category-lifestyle ast-grid-common-col ast-full-width ast-article-post" id="post-3679" itemtype="https://schema.org/CreativeWork" itemscope="itemscope">

-->

class="post-3673 post type-post status-publish format-standard has-post-thumbnail hentry category-nature ast-grid-common-col ast-full-width ast-article-post" id="post-3673" itemtype="https://schema.org/CreativeWork" itemscope="itemscope">

Cities are rapidly expanding, often at the expense of green spaces. Yet, amid towering skyscrapers and congested streets, urban farming emerges as a powerful antidote, transforming concrete jungles into thriving green sanctuaries.

India’s urban areas are expected to house 40% of its population by 2030. The challenge: balancing growth with sustainability. Urban agriculture is rising as a strategic solution. According to a report by MarketsandMarkets, the global urban farming market is projected to reach $288.71 billion by 2030, growing at an impressive CAGR of 9.6%.

Take Bengaluru, for instance, where urban farming initiatives have rejuvenated abandoned spaces, turning them into productive food hubs. Community farms there have notably reduced local temperatures by up to 2°C, significantly improving air quality and reducing pollution levels by up to 20%.

At our urban farms, I see firsthand how technology and tradition intersect beautifully. Smart hydroponic systems use 90% less water compared to traditional agriculture, and AI-driven farming practices increase crop yields by up to 30%.

Urban farming isn’t merely about ecological benefit, it offers substantial economic returns. According to FAO, urban agriculture provides employment to over 100 million people globally, significantly boosting local economies.

A recent visitor, an influential city planner, reflected, “Urban farming isn’t a trend, it’s an urban lifeline.” He’s right. It’s more than planting seeds, it’s about nurturing cities for future resilience.

In India’s urban evolution, green sanctuaries aren’t just attractive, they’re essential. Urban farming offers a proven pathway to sustainability, livability, and economic vitality.

Because thriving cities are those that learn to grow, sustainably.

-->

class="post-3633 post type-post status-publish format-standard has-post-thumbnail hentry category-lifestyle category-nature ast-grid-common-col ast-full-width ast-article-post" id="post-3633" itemtype="https://schema.org/CreativeWork" itemscope="itemscope">

Political tensions rise, markets shift rapidly, yet investments in sustainability steadily climb. What’s driving this quiet but powerful shift? The compelling strategic alignment between profit, politics, and planetary health.

Global sustainability-focused investments have surged dramatically, crossing the $30 trillion mark according to the Global Sustainable Investment Alliance. In India alone, green ventures have seen an impressive 60% increase in investments over the last five years, signaling an unmistakable trend: sustainability is no longer niche it’s mainstream and politically astute.

Today’s leading politicians and business tycoons understand that sustainable ventures offer more than green returns they represent stability in politically uncertain climates. Recent data from Deloitte indicates that sustainable businesses outperform traditional investments by nearly 20% during periods of economic downturn.

At our urban farms, I’ve personally witnessed how green investments fortify against economic and political volatility. Utilizing AI and data-driven agricultural practices, urban farms reduce resource wastage significantly, driving profitability even amidst fluctuating economic indicators.

A seasoned investor recently remarked, “Sustainability isn’t just ethical it’s economically resilient.” Political figures, too, increasingly advocate for sustainability to foster economic stability, job creation, and voter support. This isn’t merely about environmental consciousness; it’s strategic governance.

Green investments aren’t just about immediate profits they’re about future-proofing. They ensure economic continuity, ecological balance, and political credibility.

Investing in sustainability is no longer just responsible it’s a powerful, strategic move. And for today’s political and financial elite, it’s becoming increasingly clear: green isn’t merely good it’s the smartest investment they can make.

-->

class="post-3627 post type-post status-publish format-standard has-post-thumbnail hentry category-nature ast-grid-common-col ast-full-width ast-article-post" id="post-3627" itemtype="https://schema.org/CreativeWork" itemscope="itemscope">

Markets frequently tremble at mere whispers of trade conflicts. Stocks fluctuate, currencies swing unpredictably, but at urban farms? The soil remains resolutely calm.

Increasingly, India’s elite—politicians, business magnates, and seasoned investors—are discreetly shifting their focus back to the earth beneath their feet. Why? Because in a volatile global environment, soil offers a steadfast refuge.

India’s urban farming sector has quietly attracted investments totaling nearly ₹2,000 crores in the past three years. It’s not just financial prudence, it’s strategic foresight in uncertain times.

Unlike volatile stocks or cryptic cryptocurrencies, soil provides tangible assurance. According to a recent survey by KPMG, 63% of high-net-worth investors in India view urban farming and sustainable agriculture as essential hedges against economic volatility.

Our urban farming ventures go beyond sustainable agriculture; they’re pillars of resilience. Advanced AI-driven technologies optimize resources, reducing water use by up to 70% and boosting productivity by approximately 40%. Urban farms aren’t just growing crops; they’re cultivating sustainability, stability, and solid returns.

A senior politician recently remarked, “Land doesn’t merely deliver returns, it offers peace of mind.” Amid fluctuating oil prices, uncertain geopolitics, and unpredictable climate events, land provides unmatched immunity compared to other assets.

Investment in urban farms today isn’t merely prudent, it’s essential. It’s an anchor in turbulent times, ensuring food security and ecological balance.

The smartest investments aren’t simply about growth above ground they’re deeply rooted in

the stability beneath.

-->

class="post-3621 post type-post status-publish format-standard has-post-thumbnail hentry category-nature category-lifestyle ast-grid-common-col ast-full-width ast-article-post" id="post-3621" itemtype="https://schema.org/CreativeWork" itemscope="itemscope">