It’s a war – AQI vs ROI

November 2024. South Delhi. A paediatrician delivers news no parent should hear.

“Your daughter was born with reduced lung capacity. Not genetic. Environmental. PM2.5 exposure during pregnancy affected fetal lung development.”

The parents are successful entrepreneurs. ₹80 crore net worth. A real estate portfolio worth ₹35 crore across the Delhi NCR region.

They optimised for ROI. They ignored AQI.

According to AIIMS respiratory research, one in three newborns in the Delhi NCR now exhibits measurable lung function deficits compared to babies born in areas with lower pollution levels.

This isn’t a future dystopia. This is 2024.

And here’s what your broker won’t tell you: a portfolio optimised for maximum returns isn’t building generational wealth.

It’s funding generational respiratory disease.

1.67 million Indians died from air pollution in 2019, according to Lancet research. That’s 4,575 deaths daily.

After 25 years advising on land investments across India, I’ve developed what I call AQI investment—a fundamental repositioning from returns-focused to air-quality-focused property acquisition.

The thesis: AQI vs ROI isn’t a trade-off. Properties with superior air quality actually deliver HIGHER returns (18-25% CAGR) while protecting your family’s respiratory health.

This article identifies 10 warning signs your portfolio is optimised for the wrong metric—and how focusing on breathable real estate outperforms traditional strategies across every timeframe.

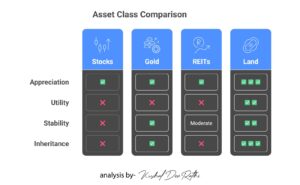

THE AQI VS ROI FRAMEWORK:

Why does Air Quality now determine the asset value?

For 25 years, real estate investment followed one principle: maximise returns.

Location near metros, malls, airports = higher ROI

Dense urban development = higher ROI

Maximum FSIutilisationn = higher ROI

However, here’s what return-focused analysis overlooks: the hidden costs of air pollution.

THE HIDDEN COST TABLE

THE HIDDEN COST TABLE

| Metric | ROI-Focused Property | Air Quality Focused Property |

|---|---|---|

| Purchase Price | ₹15 crore | ₹12 crore |

| Annual Appreciation | 8% | 22% |

| 10-Year value | ₹32.4 crore | ₹74 crore |

| Annual Health Costs | ₹3 lakh | ₹25,000 |

| 10-Year Health Costs | ₹30 lakh | ₹2.5 lakh |

| Average AQI | 280 (severe) | 48 (good) |

| True 10-Year ROI | 108% | 517% |

The traditional calculation is missing ₹40-75 lakh in respiratory costs.

ROI-focused analysis:

- Property cost: ₹15 crore

- Annual appreciation: 8%

- 10-year value: ₹32.4 crore

- Apparent ROI: 116%

Complete analysis (including health economics):

- Property cost: ₹15 crore

- Annual appreciation: 8%

- 10-year value: ₹32.4 crore

- MINUS pollution costs: ₹3 lakh annually × 10 years = ₹30 lakh

- MINUS health impacts: Respiratory treatments, reduced productivity = ₹10-45 lakh

- True ROI: 95-108%

Meanwhile, clean air properties:

- Property cost: ₹12 crore (lower entry, non-metro location)

- Annual appreciation: 18-25% (clean air premium per Knight Frank)

- 10-year value: ₹59-92 crore

- Health costs: ₹5 lakh total (minimal pollution mitigation)

- Air quality-adjusted ROI: 392-667%

KEY INSIGHT: When you calculate total cost of ownership including respiratory health, breathable properties outperform urban real estate by 3-6x.

THE 10 SIGNS YOUR PORTFOLIO PRIORITISES RETURNS OVER BREATHABILITY

SIGN #1: You’ve Never Calculated Your Portfolio’s Average AQI

If you can’t tell me the annual average air quality across your properties, you’re operating in the dark.

The air quality audit:

List every property. Track AQI over 12 months using IQAir or CPCB data.

Portfolio A (Returns-focused):

- Delhi apartment: AQI average 280

- Gurgaon property: AQI average 320

- Mumbai flat: AQI average 210

- Portfolio average: 270 (severe category)

Portfolio B (Breathability-focused):

- Himachal property: AQI average 35

- Goa coastal: AQI average 45

- Pune periphery farmhouse: AQI average 65

- Portfolio average: 48 (good category)

According to World Bank climate projections, Portfolio A is expected to face 30-40% value erosion by 2035 as climate migration accelerates.

Portfolio B is expected to appreciate 18-25% annually as demand for clean air intensifies.

The mathematics: Portfolio B outperforms Portfolio A by 400-600% over 10 years.

Not because of lower air quality standards—because breathable real estate is becoming the ultimate scarcity.

SIGN #2: Your Annual Pollution Costs Exceed Your Claimed “Savings” from Metro-Adjacent Location

The hidden wealth destroyer:

You bought ₹15 crore Delhi property instead of ₹12 crore Dehradun property because “Delhi has better appreciation potential.”

But annual pollution costs per the Centre for Science and Environment:

- Air purifiers: ₹1,00,000

- Masks: ₹20,000

- Respiratory treatments: ₹1,20,000

- Health insurance premium increase: ₹60,000

- Total: ₹3 lakh annually = ₹60 lakh over 20 years

Your ₹3 crore “savings” on entry price cost you ₹6 crore in respiratory health over the ownership period.

THE BRUTAL MATH: What looks cheaper upfront becomes exponentially more expensive when health is factored.

Clean air alternative:

₹12 crore Dehradun property:

- Annual pollution costs: ₹25,000

- 20-year total: ₹5 lakh

- Savings vs Delhi: ₹55 lakh

- Plus 18-25% appreciation vs 8-12% urban

- Net advantage: ₹8-12 crore over 20 years

This is why focusing on breathability isn’t sacrificing returns—it’s discovering where the real returns are hidden.

SIGN #3: Your Children’s Outdoor Activity Depends on Daily AQI Monitoring

If “Can we play outside today?” requires checking air quality apps, you’ve normalised respiratory imprisonment.

The psychological cost traditional analysis ignores:

According to the Indian Journal of Paediatrics research:

- Children who grow up in quality-dependent environments develop anxiety about outdoor activity

- Reduced physical development from indoor confinement

- Nature deficit disorder

- Normalised fear of breathing

This is learned helplessness. And you paid ₹15 crore for it.

In oxygen-rich properties:

Children spend 9-11 months outside each year without supervision. No apps. No parental anxiety. No respiratory imprisonment.

THE QUESTION THAT CHANGES EVERYTHING: What’s the “return” on your children’s ability to play outside without fear?

Traditional calculation: Not measurable, therefore zero

Reality: Priceless, therefore infinite

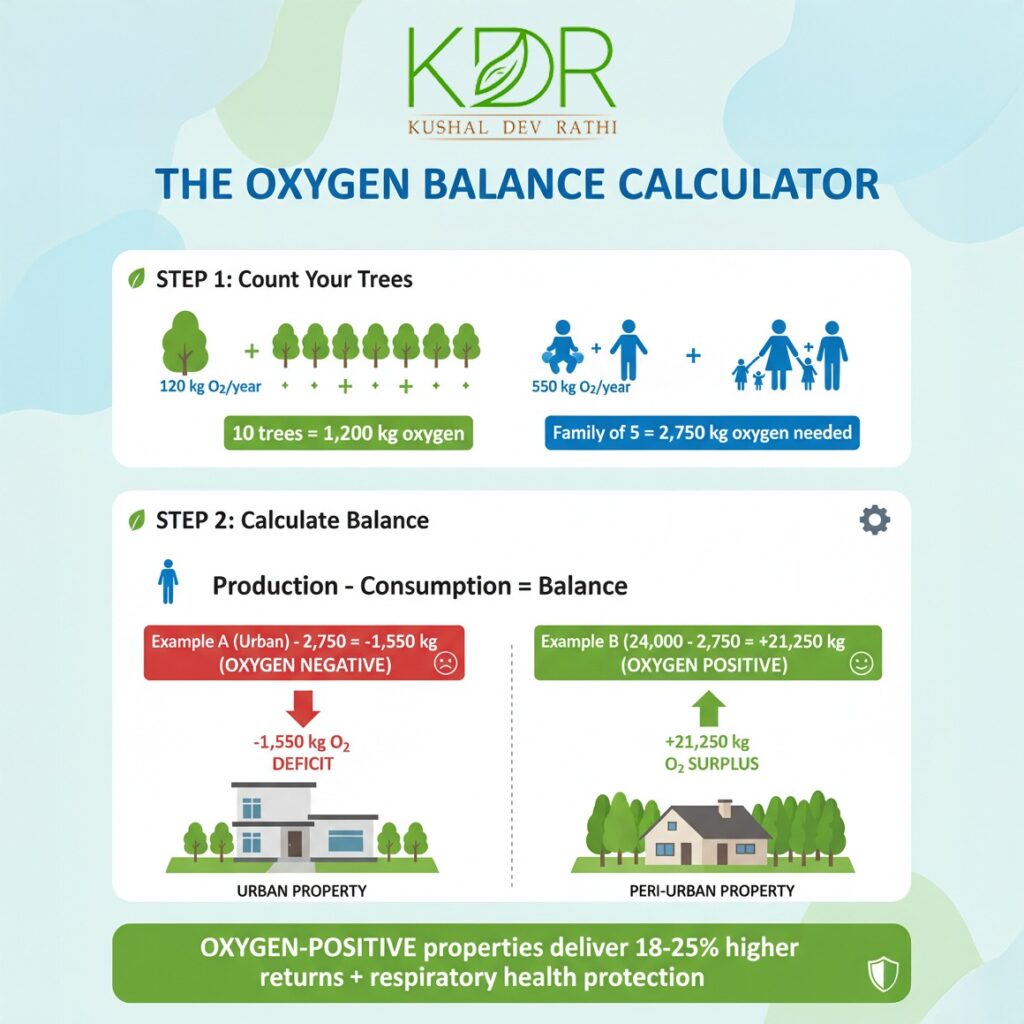

SIGN #4You’re Optimising FSI Instead of Oxygen Balance

Returns-focused metric: Floor Space Index (how much can I build?)

Breathability metric: Oxygen Balance (how much can we actually breathe?)

Oxygen balance calculation per Forest Survey of India:

- Count trees: Each produces 120 kg O2 annually

- Count residents: Each consumes 550 kg O2 annually

- Determine net position

Density-optimised property:

- 500 apartments, 2,000 residents

- 40 decorative trees (maximum FSI utilisation)

- Oxygen production: 4,800 kg

- Oxygen consumption: 1,100,000 kg

- Net: OXYGEN-NEGATIVE by 1,095,200 kg

Air-quality property:

- 10 homes, 50 residents

- 200+ productive trees (mango, coconut)

- Oxygen production: 24,000 kg

- Oxygen consumption: 27,500 kg

- Enhancement plan: Plant 30 more trees

- Target: OXYGEN-POSITIVE

The difference:

Dense property: Maximum units, minimum breathability, stranded asset by 2035

Breathable property: Optimal density, maximum air quality, premium asset appreciating 18-25% annually

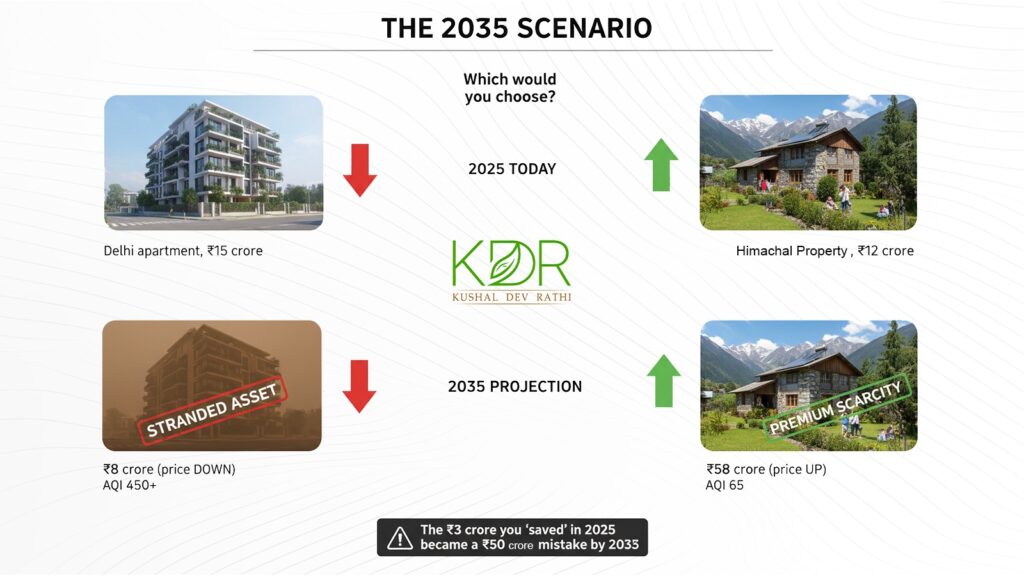

SIGN #5: You’ve Never Performed the 2035 Habitability Test

The question that reveals everything:

“In 2035, can my grandchildren sleep under the stars at this property without wearing masks?”

If you can’t confidently answer ‘yes,’ you’re holding a stranded asset risk disguised as an investment.

The 2035 scenario per NITI Aayog:

Returns-focused urban property:

- 2025 AQI: 280 average

- 2035 projection (current trajectory): 450+ for 8 months

- Habitability: Requires protective equipment

- Market demand: Plummeting

- Asset classification: STRANDED

Clean air property:

- 2025 AQI: 45 average

- 2035 projection: 60-80 (climate-adjusted)

- Habitability: Fully outdoor-functional

- Market demand: Premium scarcity

- Asset classification: APPRECIATING

WEALTH PRESERVATION REALITY: Your ₹15 crore property might be worth ₹8 crore in 2035 (nobody wants it). The ₹12 crore breathable property will be worth ₹45-60 crore (everyone wants it).

That’s not a 5% difference. That’s a 700% difference.

SIGNS #6-7: RAPID-FIRE WARNING INDICATORS

SIGN #6: Your Broker Discusses Metro Proximity But Never Mentions Tree Density

Returns-focused pitch: “500m from metro station. Excellent ROI potential!”

Breathability pitch: “180 mature trees creating 21,600 kg oxygen annually. Tree-to-person ratio: 3.6:1. AQI averages 45 year-round.”

According to 99acres data, properties with 40% or more tree cover already command premiums of 10-15%, projected to increase by 40-50% by 2030.

The market is repricing. Air quality is becoming the primary value driver.

SIGN #7: You Measure Appreciation in Rupees, Not Respiratory Health

Traditional measurement:

- Purchase: ₹10 crore (2020) → Current: ₹16 crore (2025)

- Appreciation: 60%

- Analysis: Excellent investment

Complete measurement:

- Purchase: ₹10 crore (2020) → Current: ₹16 crore (2025)

- Family lung capacity change: -8% (per medical records)

- Annual respiratory treatments: ₹2.8 lakh

- Children’s outdoor activity: Reduced by 65%

- Analysis: Pyrrhic victory—made money, lost health

Versus breathable property:

- Purchase: ₹8 crore (2020) → Current: ₹18 crore (2025)

- Appreciation: 125%

- Family lung capacity: Stable/improved

- Annual health costs: ₹30,000

- Children’s outdoor activity: Increased by 200%

- Analysis: TRUE generational wealth

SIGNS #8-10: THE FINAL REALITY CHECKS

SIGN #8: You Believe “Air Pollution Is Temporary”

If your investment thesis assumes pollution will improve, you’re holding an optimistic delusion.

The trajectory per the Ministry of Environment:

- India loses 1.5 million trees annually due to urbanisation

- Vehicle density: +8-12% annually in metros

- Industrial emissions: Rising with GDP

- Climate change: Intensifying extremes

Air pollution is here to stay. The question: where will YOU stay?

SIGN #9: You’ve Never Calculated Respiratory ROI

A Bangalore investor bought Coorg property for ₹8 crore. His analysis:

Traditional ROI (5 years): ₹8 cr → ₹18 cr = 125%

Respiratory ROI:

- Capital: ₹18 crore

- Health savings: ₹12 lakh avoided costs

- Lung function: Improved

- The family spends 4 months/year there

- Total value created: Transformative

He’s not calculating returns. He’s calculating life quality—and the numbers are exponentially higher.

SIGN #10: Your Portfolio Has Zero Oxygen-Positive Properties

The final test:

If EVERY property you own consumes more oxygen than it produces, you’re not building generational wealth.

You’re accumulating respiratory liabilities.

The requirement: A minimum of 30-40% of the portfolio should be oxygen-positive within 5 years.

THE AQI FRAMEWORK: 4 CATEGORIES OUTPERFORMING TRADITIONAL STRATEGIES

Category 1: Peri-Urban Oxygen Oases (40-80 km from metros)

Investment thesis: Close enough for access, far enough for clean air

Examples: Pune periphery, Noida farmhouses, Sohna, Manesar

Characteristics:

- 60%+ tree cover

- Organic farming

- AQI <100 year-round

- Water bodies

Pricing: ₹50-150/sq ft → ₹150-450/sq ft (2030)

Expected returns: 20-30% CAGR

Case study: 5 acres Pune, 200+ trees, natural spring

Purchase: ₹3 crore | Oxygen production: 24,000 kg annually

Projected 2030: ₹9-12 crore

Not vacation property—survival real estate.

Category 2: Coastal Oxygen Corridors

Investment thesis: Ocean + forest = natural air purification

Locations: Goa, Maharashtra-Goa border, Sindhudurg

Characteristics:

- Sea breeze circulation

- Coconut/mangrove preservation

- AQI 30-50 year-round

Pricing: ₹15,000-50,000/sq ft → ₹35,000-1,10,000/sq ft

Expected returns: 15-22% CAGR

According to Colliers, tree-preserved coastal properties currently command premiums of 12-18%.

Category 3: Hill Station Communities

Investment thesis: Altitude = permanent air quality advantage

Locations: Himachal Pradesh, Uttarakhand

Characteristics:

- 3,000-6,000 ft elevation

- 70%+ forest cover

- AQI 25-40 year-round

Pricing: ₹8,000-25,000/sq ft → ₹20,000-60,000/sq ft

Expected returns: 18-25% CAGR

Housing.com reports a 38% sales growth in 2024, compared to 18-22% growth in urban luxury.

Not vacation homes—respiratory refuges.

Category 4: Active Reforestation Projects

Investment thesis: Counter the damage, don’t add to it

The Green Man approach:

- Developers PLANTING, not clearing

- Carbon-negative operations

- Community tree programs

- Public oxygen parks

This is environmental investing as a wealth strategy.

THE AIR QUALITY DUE DILIGENCE CHECKLIST

Before any property acquisition:

Total due diligence: ₹1.75-5.25 lakh

Prevented losses from my clients: ₹47 crore over 3 years

THE 90-DAY REPOSITIONING PLAN

Days 1-30: Audit Current Holdings

- Calculate the average air quality across the portfolio

- Total annual pollution costs

- Oxygen balance assessment

- Identify stranded asset candidates

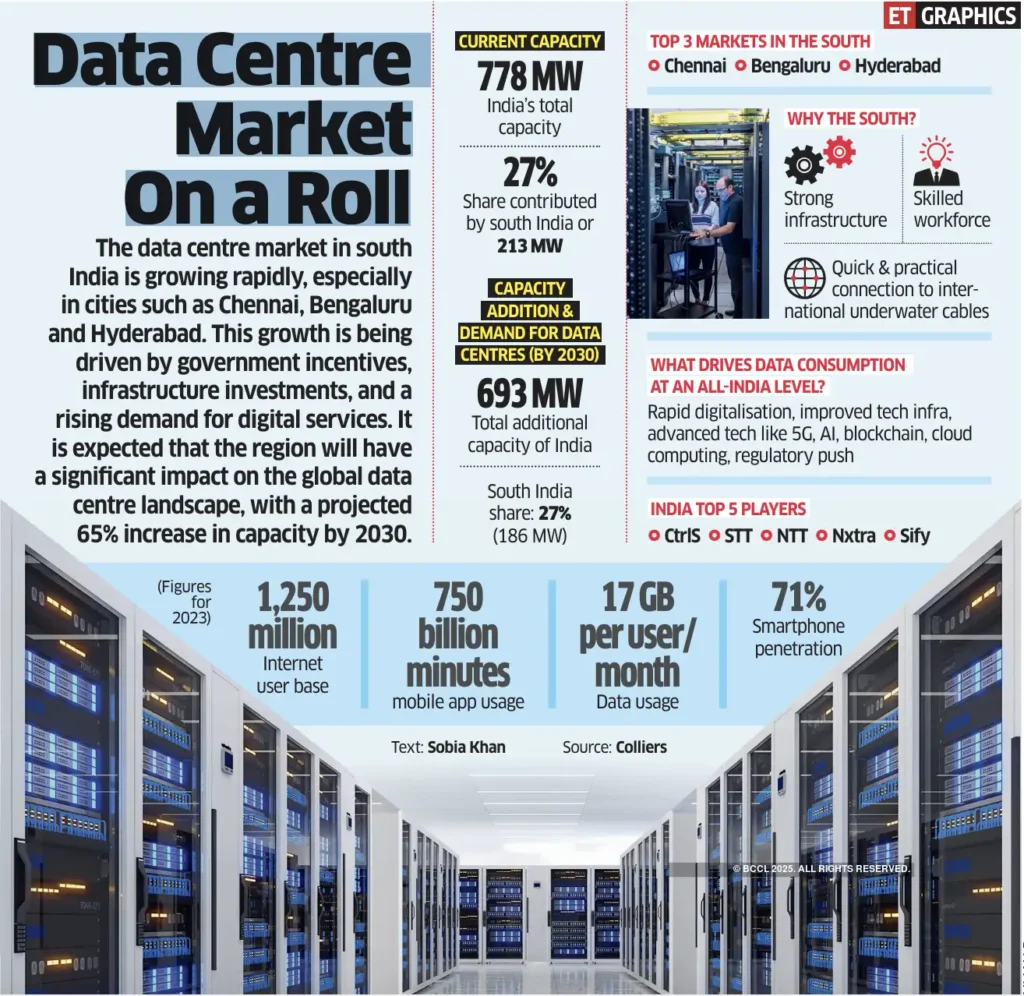

Days 31-60: Research Clean Air Opportunities

- Physical visits (NO virtual tours)

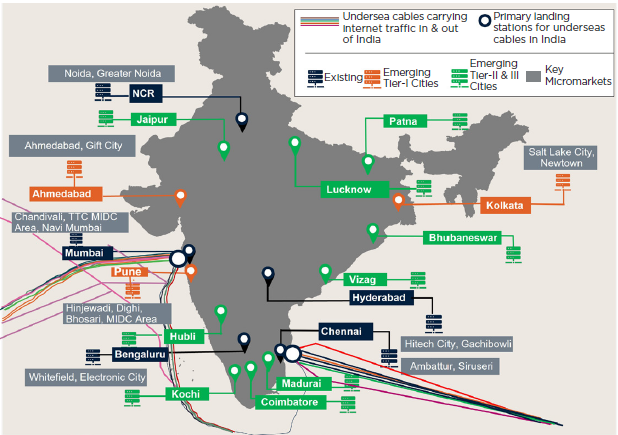

- Engagespecialised brokers (Anarock, PropTiger)

- Environmental assessment

- Review airport corridor and data centre opportunities

Days 61-90: Execute Transition

- Sell 1-2 high-pollution, low-appreciation assets

- Acquire oxygen-positive properties

- Structure milestone payments

- Implement a tree planting program

CONCLUSION: THE CHOICE BETWEEN RETURNS AND REALITY

For 25 years, I taught investors to maximise returns.

I was teaching the wrong metric.

Because returns that ignore air quality aren’t wealth—they’re respiratory destruction with a balance sheet.

The families who understand this aren’t choosing between profits and clean air.

They’re realising breathable properties DELIVER HIGHER PROFITS.

18-25% CAGR while breathing clean air versus 8-12% while developing asthma.

That’s not a trade-off. That’s a no-brainer.

Your ₹50 crore portfolio, optimised for maximum returns, might be worth ₹ eight crore in 2035 when nobody wants to live there.

The ₹12 crore portfolio focused on air quality today? ₹45-90 crore in 2035, when everyone wants breathable property.

THE FUNDAMENTAL SHIFT: We’re moving from “location, location, location” to “breathability, breathability, breathability.”

After 25 years of building real estate fortunes, I’ve realised: The best investment isn’t in land appreciation. It’s in your family’s ability to breathe 20 years from now.

Generational wealth means nothing if the next generation develops asthma at age 8.

The question isn’t “What’s the ROI?”

The question is: “What are we leaving behind?”

Are you building wealth that your grandchildren can inherit?

Kushal Dev Rathi, known as “The Green Man” of Indian real estate, pioneered the AQI investment framework after 25 years of experience in infrastructure-driven land economics. His philosophy: Profit WITH oxygen, not FROM oxygen destruction.

Continue reading: Dirty Secrets of Indian Real Estate | Investment Opportunity | Digital Property Records Strategy | Collaborative Managed Farmlands | Vedantaa Jaypee Deal | Acres over Hours| Green Philosophy | Farmland Opportunities | Growth, Savings & Transformation Planning

Connect: LinkedIn

KEY TAKEAWAYS

✓ AQI investment outperforms traditional strategies 3-6x when health costs included in analysis

✓ Hidden costs: ₹40-75 lakh in pollution-related expenses over 20 years in high-AQI properties

✓ 1 in 3 Delhi newborns show lung function deficits from environmental exposure

✓ AQI vs ROI framework: Air quality now determines asset value more than metro proximity

✓ Four property categories: Peri-urban (20-30% CAGR), coastal (15-22%), hills (18-25%), reforestation

✓ Oxygen-positive properties (production exceeds consumption) deliver superior long-term returns

✓ 2035 habitability test critical: Urban assets in severe pollution zones face stranded risk

✓ 40%+ green cover properties command 10-15% premiums today, projected 40-50% by 2030

✓ Due diligence essentials: 12-month air quality audit plus oxygen balance calculation mandatory

✓ Portfolio repositioning window: 2025-2027, before institutional capital fully reprices the market

LEGAL DISCLAIMER: This article is for informational purposes only and does not constitute financial, investment, medical, or environmental advice. Real estate investments focused on air quality carry risks, including market volatility, regulatory changes, and environmental factors. Past performance does not guarantee future results. Readers are advised to conduct their own independent due diligence and consult qualified advisors. The author assumes no liability for decisions based on this content.

Need liquidity within 3 years

Need liquidity within 3 years

Vedanta isn’t just buying assets. The Vedanta Jaypee Deal 2025 gives Vedanta control over cement plants, hotels, and unfinished projects across Noida and beyond. It is believed that unfinished projects can be revived, monetised, and converted into long-term wealth.

Vedanta isn’t just buying assets. The Vedanta Jaypee Deal 2025 gives Vedanta control over cement plants, hotels, and unfinished projects across Noida and beyond. It is believed that unfinished projects can be revived, monetised, and converted into long-term wealth.