Table of Contents

ToggleCARBON CREDIT IN INDIA 2025: THE NEW WEALTH HIDDEN IN OUR SOIL

THE ECONOMY INDIA NEVER SAW COMING — UNTIL NOW

There comes a moment in a nation’s journey when wealth stops coming from factories, markets, and balance sheets—and begins rising quietly from land, forests, and soil.

India is standing in that moment right now.

Every industry is measuring its emissions.

Every corporate board is recalculating the cost of carbon.

Every policymaker is assigning a financial value to air we pollute and to land we restore.

And without fanfare, without noise, without celebration… a new economy is being born.

This new economy is called carbon credit in India.

You cannot touch it.

You cannot see it.

But it is shaping:

- how factories operate,

- how land is valued,

- how forests are protected,

- how investors behave,

- and how India will grow in the next 25 years.

For decades, India treated emissions as environmental issues.

Now they are financial assets and liabilities.

For decades, India treated forests as scenery.

Now they are becoming carbon banks.

For decades, rural India was left out of the wealth conversation.

Now it may become the center of a new economic revolution.

But here is a truth most people are not ready to hear:

Carbon credit in India is not simply a climate policy.

It is a land policy.

It is a soil policy.

It is a future policy.

And this is where our story begins.

INDIA’S QUIET REVOLUTION: THE DAY CARBON BECAME LAW

For years, the phrase carbon credit in India floated around in climate reports, sustainability conferences, and corporate presentations.

But on 8 October 2025, everything changed.

The Ministry of Environment, Forest & Climate Change issued the

Greenhouse Gases Emission Intensity Target Rules, 2025,

turning carbon obligations into legal obligations.

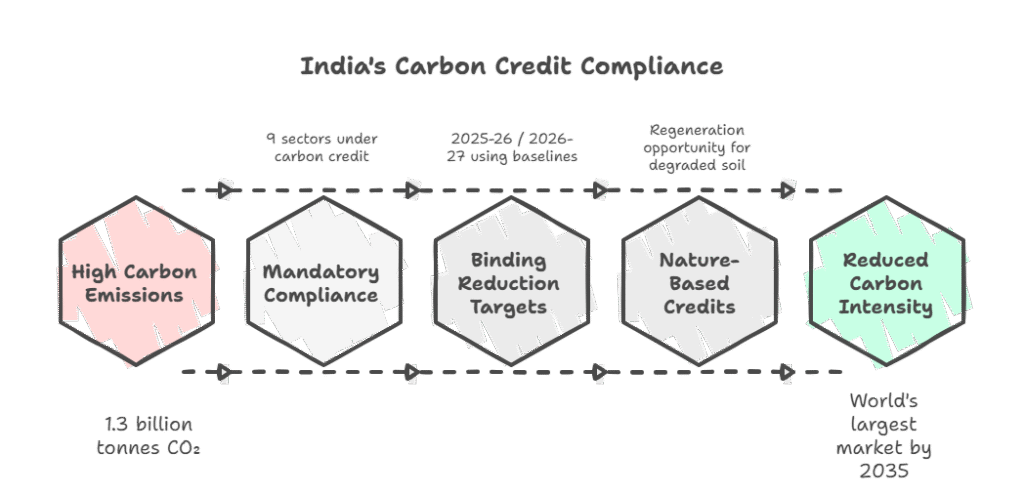

This is the day carbon compliance in India became law, not opinion.

What did this rule do?

1. It operationalised the Carbon Credit Trading Scheme (CCTS).

CCTS was introduced in 2023, but without rules, it was a skeleton.

Now it has muscles, movement, and legal teeth.

2. It imposed mandatory emission-intensity targets.

Not for everyone.

But for the nine biggest emitting sectors of India:

- Power

- Cement

- Steel

- Fertiliser

- Petrochemicals

- Refineries

- Pulp & paper

- Aluminum

- Chlor-alkali

3. It created a new economic reality.

If a company emits more than allowed → it must buy carbon credit in India.

If a company emits less → it can sell carbon credit in India.

For the first time in India’s history, pollution became a cost.

And regeneration became revenue.

This is how nations change—not through speeches, but through systems.

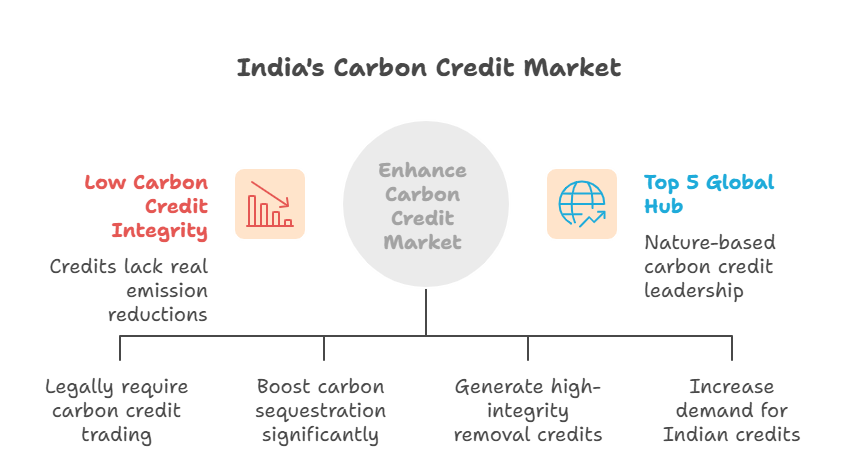

UNDERSTANDING THE TWO ECONOMIES OF CARBON CREDIT IN INDIA

Most people believe carbon credits belong to one world.

They do not.

Carbon credit in India exists in two completely different universes.

UNIVERSE 1 — COMPLIANCE CREDITS (MANDATORY)

Created for industrial emitters.

Purchased to meet legal targets.

Regulated by the government.

Verified at national level.

This is where:

- cement plants

- steel mills

- thermal power stations

- refineries

…will buy and sell carbon credit in India to stay compliant.

This is the “hard carbon market.”

Industrial.

Strict.

Regulated.

Mandatory.

UNIVERSE 2 — VOLUNTARY / NATURE-BASED CREDITS (CHOICE)

This is where forests live.

This is where soil breathes.

This is where wetlands and mangroves heal the land.

Nature-based credits represent:

- regeneration

- sequestration

- restoration

These are generated by:

- agroforestry projects

- grassland regeneration

- soil carbon improvement

- watershed restoration

- mangrove expansion

- native forest projects

These projects generate voluntary carbon credit in India, which are purchased by:

- corporates seeking net-zero

- ESG funds

- global carbon markets

- sustainable investors

One economy emerges from industry.

The other grows from land.

And the future of India lies in the second.

COMMON MISUNDERSTANDINGS ABOUT CARBON CREDIT IN INDIA

Carbon credits are exploding in popularity across India.

Unfortunately, misinformation is exploding faster.

Let’s untangle the biggest misconceptions—clearly and honestly.

“Planting trees creates carbon credits.”

Planting a tree does not automatically create revenue.

It creates shade, perhaps.

Not carbon credit in India.

Credits require:

- baseline measurement

- verified carbon sequestration

- 20–30 years of permanence

- monitoring

- audit trails

- leakage assessment

- land rights

Without these, a tree is a tree.

Not a credit.

“All land can generate carbon credit in India.”

No.

Most land cannot.

Eligible land must:

- follow a science-backed methodology

- commit to long-term conservation

- avoid double-counting

- show measurable carbon increase

- be free of land conflicts

This is why credible projects take years to build.

“Carbon credit in India will make you rich quickly.”

No.

High-integrity carbon credits take:

- time

- science

- community engagement

- ecological healing

Cheap credits died after the Kariba scandal.

In 2025, global markets reward integrity—not shortcuts.

Annual Reviews study: Only 16% of global voluntary credits result in real climate benefit.

“Carbon credits will have European prices.”

Europe’s ETS trades at ~€70–€90 per tonne.

India will be lower initially due to:

- intensity-based targets

- early-stage market

- evolving stability mechanisms

Price will grow—slowly, steadily, sustainably.

“Carbon is an air problem.”

Carbon is not an atmospheric story.

It is a soil story.

Carbon lives in:

- roots

- humus

- biomass

- wetlands

- mangroves

- forests

- grasslands

Air only carries the message.

Land writes the message.

This is why the future of carbon credit in India is not in factories—it is in forests.

WHY THE WORLD IS FORCING INDIA TO TAKE CARBON SERIOUSLY

Carbon is now a global currency.

And India cannot afford to stay outside this new economy.

Here’s why.

The EU Carbon Border Adjustment Mechanism (CBAM)

Beginning January 2026, the EU will impose a carbon tax on imports.

Steel, cement, aluminium, fertilisers—India exports all of them.

If India doesn’t reduce carbon emissions, EU will:

- charge Indian companies carbon tax at EU rates, or

- block exports in extreme cases

This makes carbon credit in India a compliance tool for global trade.

Indonesia Reopening Forest Carbon Exports (2025)

In October 2025, Indonesia re-entered the forest carbon market with new integrity rules.

Indonesia is now competing in carbon supply.

India must not fall behind.

Global Market Reforms After Scandals

After the Zimbabwe Kariba scandal, voluntary carbon markets changed dramatically.

- stricter verification

- new methodologies

- removal-focused credits

- community rights enforcement

- stronger MRV systems

India must meet these standards for carbon credit in India to be internationally accepted.

HOW CARBON CREDIT IN INDIA WILL RESHAPE LAND OWNERSHIP (2025–2035)

This is the part no one is talking about.

But this is the part that will change India forever.

Carbon credit in India will shift the value of:

1. Agricultural land

Agroforestry will fetch premiums.

Regenerative farming will earn carbon revenue.

2. Forest land

Native forests will become carbon banks.

But only under community rights, not misuse.

3. Degraded land

Restoration projects will create long-term carbon value.

4. Water bodies & wetlands

Wetlands capture massive carbon.

They will become ecological assets.

5. Rural landscapes

Tribal and village communities will become carbon stewards.

Carbon credit in India is not a technical system.

It is a rural wealth revolution waiting to happen.

WHAT FARMERS, LANDOWNERS & DEVELOPERS MUST UNDERSTAND NOW

(1) Regeneration is the new income.

Healthy soil = higher carbon stocks = carbon revenue.

(2) Carbon takes time.

Real projects take 2–3 years to mature.

(3) Documentation matters.

Without baselines, no carbon credit in India can be issued.

(4) Community rights are non-negotiable.

FPIC (Free Prior Informed Consent) is mandatory under global rules.

(5) India’s Article 6.2 market will open premium opportunities.

High-integrity projects can sell credits globally.

THE 2030 VISION: WHAT INDIA MUST BUILD

For carbon credit in India to unlock its full potential, we need:

→ A unified national registry

Transparent, digital, traceable.

→ Strong soil carbon methodologies

India’s soil is degraded; restoring it is a trillion-rupee opportunity.

→ Ecosystem-first, not plantation-first design

Monocultures destroy biodiversity.

→ Fast but fair approvals

Community rights + scientific verification.

→ Financial literacy for carbon farmers

Rural India needs access, not complexity.

THE PHILOSOPHY OF CARBON

When I walk through a forest in Sariska…

When I stand on a ridge in North Goa…

When I sit by a stream in Himachal…

I realise one thing:

Carbon is not a villain.

Carbon is memory.

It remembers:

- the soil you restored,

- the forest you protected,

- the land you honoured,

- or the land you destroyed.

Carbon credit in India is not the point.

Carbon consciousness is.

The air is only the messenger.

The soil is the message.

And the land is the witness.

The future of wealth will not come from what we build above ground—

but from what we rebuild below it.

If pollution taught India one hard truth,

it is this:

Wealth belongs to those who think ahead.

And if carbon credit in India teaches us anything,

it will be this:

The future belongs to those who restore, not exhaust.

The smartest investment any Indian family can make today?

Land that regenerates.

Land that heals.

Land that stores carbon, water, life, and legacy.

Not because carbon credit in India will pay for it—

but because your children will breathe because of it.

FAQs

1. What is carbon credit in India and how does it actually work on the ground?

Carbon credit in India is a measurable, verifiable unit that represents one tonne of reduced, avoided, or removed CO₂ emissions.

But unlike many countries that adopted carbon markets decades ago, carbon credit in India is designed as a dual system:

A. Compliance Carbon Credits

These are mandatory for India’s largest emitting industries.

Under India’s Carbon Credit Trading Scheme (CCTS), sectors like:

- cement

- steel

- power

- fertiliser

- petrochemicals

must reduce their emission intensity every year.

If they cannot meet targets, they must buy carbon credit in India to cover the gap.

If they overachieve, they earn carbon credits.

This makes carbon credit in India a legally backed financial instrument, not just a climate idea.

B. Voluntary / Nature-Based Carbon Credits

These are created from:

- forests

- wetlands

- mangroves

- regenerative agriculture

- grassland restoration

- soil carbon projects

These credits are purchased voluntarily by companies aiming for:

- net-zero emissions

- ESG goals

- carbon neutrality

This side of carbon credit in India is especially powerful because it rewards restoration, not just prevention.

Together, these two markets show that carbon credit in India is not just about counting emissions—it is about revaluing the country’s land and ecological systems.

2. Why is carbon credit in India becoming so important now?

Three forces have collided to make carbon credit in India a national priority:

1. Legal Pressure (Domestic)

With the October 2025 rules, industrial decarbonisation is now enforced by law.

Companies cannot ignore emissions anymore.

They must buy carbon credit in India to stay compliant.

2. Economic Pressure (Global Trade)

Europe’s CBAM (Carbon Border Adjustment Mechanism) will tax Indian exports with high carbon footprints starting 2026.

If exporters don’t reduce emissions, they must buy certified carbon credits.

This makes carbon credit in India essential for protecting India’s export economy.

3. Ecological Pressure (Land & Climate)

India’s soil is degrading, forests are fragmenting, and climate impacts are intensifying.

Regenerative land-use practices that generate carbon credit in India also improve:

soil health

water retention

biodiversity

microclimates

This makes carbon credit in India not just a compliance tool—but a land-healing tool.

3. Who can actually earn money from carbon credit in India?

This is one of the most misunderstood questions.

Here is the real answer:

A. Industrial Entities

If industries reduce their emissions beyond mandated limits, they earn compliance credits.

B. Large Landowners

Owners of:

degraded land

grasslands

forested land

agricultural land

…can participate in nature-based carbon projects.

C. Farmers (Individually or as Groups)

Farmers can earn carbon credit in India through:

agroforestry

cover cropping

regenerative agriculture

soil carbon enhancement

low-tillage practices

A single farmer may earn modest revenue, but farmer-producer companies (FPCs) and community clusters can earn significant value.

D. Tribal Communities

Communities managing forest landscapes under FRA (Forest Rights Act) can generate forest-based credits.

E. Developers (Eco-centric)

Developers building:

regenerative resorts

eco-villages

forest communities

land restoration projects

…can embed carbon credit in India into long-term land valuation.

F. Investors

ESG funds and nature-based funds can invest in land restoration and earn returns from carbon credits.

In short, anyone who restores land or reduces emissions can participate in carbon credit in India—but only through verified, transparent, long-term projects.

4. Are forest projects reliable for generating carbon credit in India?

Forest projects are powerful—but only when designed correctly.

They must follow high-integrity rules:

1. Additionality

The forest must grow or revive only because of the project—not because it was naturally happening anyway.

2. Permanence

The carbon must stay locked for decades (usually 20–40 years).

If forests burn, are cut, or degrade, credits can be revoked.

3. Leakage Control

You cannot stop deforestation in one area if it shifts deforestation to another area.

4. Monitoring & Verification

Credible forest-based carbon credit in India requires satellite monitoring, drone assessments, growth plots, and third-party audits.

5. Community Consent (FPIC)

Forest carbon projects cannot proceed without tribal rights, community consent, and benefit sharing.

If these conditions are met, forest-based carbon credit in India becomes one of the most valuable climate assets in the world.

5. How is the price of carbon credit in India determined?

There is no single fixed price.

Price depends on what type of credit you generate:

A. Compliance Credits

These will be governed by:

supply & demand

industry performance

national targets

regulatory caps

economic cycles

Initial price may be lower, but as targets tighten, value will rise.

B. Voluntary Credits

Voluntary carbon credit in India is priced by:

project type (forest > soil > renewable energy)

carbon quality

permanence guarantees

monitoring intensity

biodiversity co-benefits

location (India is rising as a premium geography)

High-integrity nature credits globally sell for ₹800–₹3,500 per tonne, depending on quality.

Over time, as rules strengthen, the price of carbon credit in India will rise significantly—especially for land-based removal credits.

6. Can farmers realistically earn meaningful income from carbon credit in India?

Yes — but only when certain conditions are met.

For farmers, carbon credit in India becomes profitable when:

✔ They work in groups.

Farmer-producer companies or collectives earn more than individuals.

✔ They use regenerative practices.

These include:

multi-layer farming

agroforestry

organic composting

reduced tillage

cover crops

watershed improvement

These improve soil carbon, which becomes measurable credit.

✔ They have long-term support.

Carbon credit in India requires baselines, audits, MRV systems, and annual reporting.

Farmers need technical partners.

✔ They integrate trees (agroforestry).

Trees pull carbon from the air into biomass.

This is one of the most powerful pathways for farmers.

If structured properly, carbon credit in India can add ₹15,000–₹45,000 per acre annually for cluster-based agroforestry projects, depending on methodology and species mix.

7. Is carbon credit in India internationally recognised?

Yes — and this is where India’s future becomes exciting.

Under Article 6 of the Paris Agreement, countries can trade carbon credits internationally.

India is building:

a national registry

internationally aligned methodologies

market integrity frameworks

This makes high-integrity carbon credit in India eligible for:

international buyers

global compliance markets

carbon removal portfolios

export under bilateral agreements

India can become a top-5 global supplier of nature-based credits between 2027–2035 if the ecosystem is built correctly.

8. Can every land parcel produce carbon credit in India?

No — and this is the misconception causing the most confusion.

Land must meet specific criteria:

A. It must have a measurable baseline.

You cannot create carbon credits from what you cannot measure.

B. It must show improvement.

Soil must regenerate.

Trees must grow.

Ecosystems must strengthen.

C. It must be protected for 20–30 years.

Short-term projects are not eligible.

D. It must avoid double registration.

No project can sell the same carbon twice.

E. It must not harm biodiversity.

Monoculture plantations will be rejected under new rules.

In short: only scientifically designed, long-term regenerative projects can generate carbon credit in India.

9. What is the long-term future of carbon credit in India (2025–2035)?

The future of carbon credit in India is enormous — but not in the way most people think.

Here is the real future:

1. Carbon → Water → Soil → Biodiversity

Regeneration will become a multi-benefit economy.

Carbon will be the entry point, not the end point.

2. Rural India will become a climate services provider.

Communities managing forests, farms, and wetlands will earn consistent revenue.

3. The most valuable carbon credit in India will be “removal credits.”

Credits created by:

forests

mangroves

grasslands

soil regeneration

wetlands

These will dominate the premium markets.

4. Land value will rise based on ecological performance.

Healthy land will become wealth.

Degraded land will become liability.

5. India will become a global carbon exporter.

With one of the world’s largest restoration potentials, India can lead nature-based markets.

The next decade is not about carbon credit in India alone.

It is about redefining the relationship between land, livelihood, and legacy.

10. Why is carbon credit in India fundamentally a land-based system?

Because carbon does not live in the sky.

It lives in the soil.

In the roots.

In the forests.

In the grasslands.

In the wetlands.

In the mangroves.

Air pollution is only the surface symptom.

Land degradation is the root cause.

And that is why:

Fix the land → Fix the carbon → Build the future.

This is the philosophy behind carbon credit in India.

It is not about offsets.

Not about trading.

Not about finance.

It is about healing India’s land — slowly, honestly, regeneratively.

When the land heals, carbon settles.

When carbon settles, climate stabilises.

When climate stabilises, societies thrive.

This is why carbon credit in India is not merely a market.

It is a mirror.

It reflects the health of our ecosystems and the wisdom of our decisions.