Table of Contents

ToggleWhy Agro Farming Land Investment Is the Quietest, Strongest Form of Wealth India Is Returning To

I Didn’t Learn This From Books. I Learned It From Land.

For most of my life, I have worked with land—not as a product, not as a commodity, but as a living system.

Over time, one pattern became impossible to ignore.

People who rushed land lost patience.

People who respected land gained resilience.

Today, as capital becomes volatile and attention spans shorten, something interesting is happening quietly across India. Thoughtful individuals are stepping away from fast money and returning to agro farming land investment—not as nostalgia, but as strategy.

This shift is not emotional.

It is intelligent.

Agro farming land investment is no longer about buying farmland and hoping something grows. It is about owning soil while participating in professionally managed agricultural systems that respect nature, law, and long-term economics.

Why Agro Farming Land Investment Is Re-Entering Serious Conversations

India has always been an agrarian civilization, but for decades we treated agriculture as backward and land as something to escape from.

Cities promised speed.

Land demanded patience.

Now, that equation is reversing.

Across India, investors, entrepreneurs, and families are realizing that agro farming land investment offers something most modern assets cannot:

- Tangibility

- Productivity

- Inflation protection

- Food security

- Ecological relevance

Unlike speculative real estate, agro farming land investment does not depend solely on market sentiment. Its value is tied to soil health, water availability, climate suitability, and management discipline.

This makes it slower—but far stronger.

Understanding Agro Farming Land Investment Beyond the Surface

At its simplest, agro farming land investment means owning agricultural land that is actively cultivated.

But true agro farming land investment goes deeper.

It involves:

- Scientific soil analysis

- Crop planning based on agro-climatic zones

- Long-term orchard or mixed farming strategies

- Professional farm operations

- Transparent reporting to landowners

This is very different from speculative farmland buying, where land is purchased and left idle.

Idle land decays.

Managed land compounds.

That is the foundational logic of agro farming land investment.

The Trust Deficit That Always Stopped People From Buying Farmland

For years, people avoided agricultural land for three reasons:

- Legal uncertainty

- Operational complexity

- Lack of reliable execution

Agro farming land investment models exist to solve exactly these three problems—without removing ownership from the buyer.

You remain the landowner.

Agriculture becomes a managed service.

This separation of ownership and execution is what allows agro farming land investment to work in modern India.

Soil Is the First Asset in Any Agro Farming Land Investment

Before discussing returns, appreciation, or income, agro farming land investment must begin with soil.

Healthy soil determines:

- Crop suitability

- Yield stability

- Water retention

- Resistance to climate shocks

Scientific soil testing is not optional—it is foundational.

India’s western coastal belts, parts of central India, and select plateau regions offer rich horticultural potential when soil science guides decisions.

In agro farming land investment, soil quality often matters more than location branding.

Agro-Climatic Intelligence: Why Location Is a Science, Not a Sales Pitch

Successful agro farming land investment depends on matching crops to climate—not forcing trends.

For example:

- Mango, cashew, coconut thrive in coastal belts

- Multi-layer horticulture stabilizes income

- Intercropping supports early cash flows

Agro farming land investment succeeds when land is chosen for what it can sustain naturally, not what is fashionable.

Legal Clarity: The Backbone of Sustainable Agro Farming Land Investment

No amount of sustainability matters if ownership is unclear.

In India, agricultural land ownership is governed by state-specific laws. In Maharashtra and several other states:

- Non-agriculturists may require district permissions

- Title verification and mutation are essential

- Land-use classification must be clear

Any credible agro farming land investment must ensure:

- Clear title

- Proper registration

- Updated land records (7/12, RTC, mutation)

Without legal clarity, agro farming land investment becomes a liability instead of a legacy.

Why Agro Farming Land Investment Must Avoid Guaranteed Returns

One of the most dangerous things in agriculture is certainty.

Weather is uncertain.

Markets fluctuate.

Nature resists shortcuts.

That is why agro farming land investment must never promise guaranteed returns.

Instead, it should focus on:

- Risk disclosure

- Time-based yield expectations

- Diversified revenue streams

SEBI regulations exist to prevent agricultural land from being mis-sold as a financial product.

Agro farming land investment works best when treated as productive ownership, not a financial scheme.

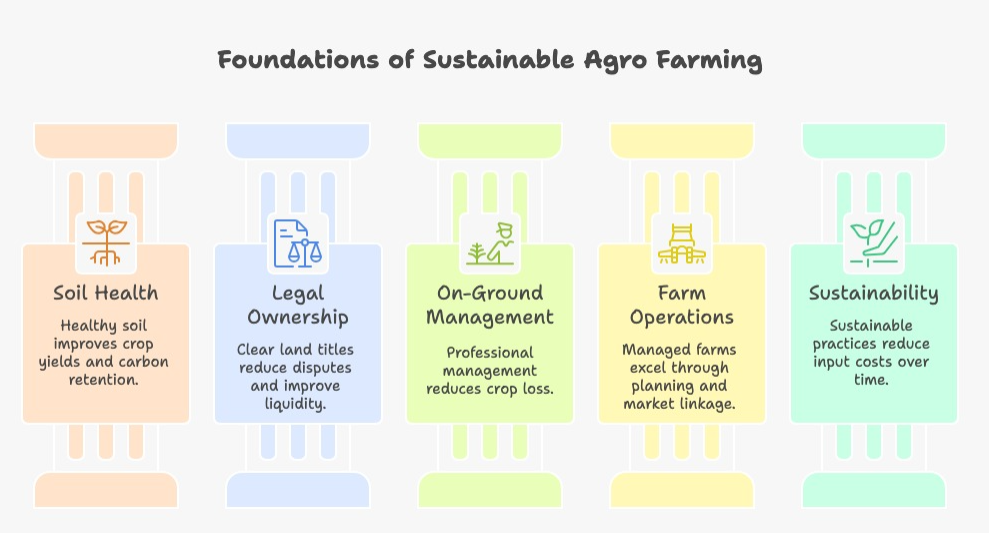

The Five Pillars That Make Agro Farming Land Investment Work

Over years of observing land projects, five pillars consistently separate success from failure.

1. Soil Stewardship

Everything begins and ends with soil.

Agro farming land investment that prioritizes:

- Organic matter

- Natural inputs

- Microbial balance

creates resilience that synthetic farming cannot replicate.

Soil is not an expense.

It is capital.

2. Safety Through Structure

Safety in agro farming land investment means:

- Individual land titles

- Clear demarcation

- Transparent documentation

This protects the landowner and prevents disputes that plague informal farmland deals.

3. Security on the Ground

Modern agro farming land investment requires:

- Physical security

- On-ground supervision

- Crop monitoring

- Periodic reporting

Technology assists, but discipline sustains.

4. Services as Systems

Most people fail at farming because they lack systems.

Managed agro farming land investment provides:

- Crop planning

- Plantation execution

- Harvest coordination

- Market linkage

This allows landowners to benefit from agriculture without daily involvement.

5. Sustainability as Strategy

Sustainability is not ideology—it is economics.

Agro farming land investment that regenerates soil:

- Reduces long-term input costs

- Increases land value

- Improves yield stability

Understanding Time Horizons in Agro Farming Land Investment

Agro farming land investment rewards patience.

Typical lifecycle:

- Years 0–2: Land preparation, plantation, intercrops

- Years 3–5: Yield stabilization, allied income

- Years 6–10: Orchard maturity, consistent output

- Beyond: Strong appreciation and generational value

This timeline filters out speculative capital and attracts committed ownership.

Income Is Not the Only Return

Agro farming land investment delivers multiple forms of value:

- Agricultural produce

- Land appreciation

- Food security

- Lifestyle access

- Ecological capital

Not everything valuable is visible on a spreadsheet.

Why Agro Farming Land Investment Aligns With India’s Future

India’s future faces three realities:

- Climate volatility

- Food demand

- Urban saturation

Agro farming land investment sits at the intersection of all three.

It supports:

- Local food systems

- Rural employment

- Environmental regeneration

This makes it both economically relevant and socially necessary.

Who Should Consider Agro Farming Land Investment

This path is not for everyone.

Agro farming land investment is suited for those who:

- Think long-term

- Respect natural cycles

- Value tangible assets

- Seek quiet compounding

It is not a shortcut.

It is a foundation.

The Emotional Intelligence of Land

Land responds differently than markets.

It does not react to noise.

It responds to care.

Those who approach agro farming land investment with humility often receive far more than they expect.

What Agro Farming Land Investment Teaches Us About Wealth

Wealth is not speed.

Wealth is stability.

Agro farming land investment reminds us that:

- Growth takes time

- Systems matter

- Roots hold value

In a world chasing immediacy, land teaches patience.

FAQ

1. What exactly is agro farming land investment?

Agro farming land investment refers to owning legally titled agricultural land that is actively cultivated through structured, professional farm management. Unlike idle farmland, this model focuses on soil health, crop planning, and long-term productivity, allowing landowners to participate in agriculture without managing daily operations themselves.

2. Is agro farming land investment legal in India?

Yes, agro farming land investment is legal in India, provided it complies with state-specific agricultural land laws, land-use classifications, and ownership eligibility norms. Proper title verification, registration, and mutation are essential before any purchase.

3. Can non-agriculturists invest in agro farming land investment?

In many Indian states, non-agriculturists can participate in agro farming land investment through collector permissions or structured legal pathways. The exact process varies by state and must be completed before registration.

4. Are returns guaranteed in agro farming land investment?

No. Agro farming land investment does not offer guaranteed or fixed returns. Agricultural outcomes depend on climate, soil health, crop cycles, and market conditions. Responsible models focus on transparency, risk disclosure, and long-term value rather than short-term promises.

5. How does agro farming land investment generate income?

Income in agro farming land investment is generated through actual agricultural activity such as orchard produce, intercropping, allied activities like honey or dairy, and sometimes agri-tourism. Land appreciation over time also contributes to overall value.

6. How important is soil quality in agro farming land investment?

Soil quality is the most critical factor in agro farming land investment. Healthy soil determines crop suitability, water retention, yield stability, and long-term land productivity. Scientific soil testing and regenerative practices significantly improve outcomes.

7. What crops are commonly chosen for agro farming land investment?

Crop selection depends on agro-climatic conditions. In suitable regions, long-term orchard crops such as mango, cashew, coconut, and mixed horticulture are preferred because they support sustainable yields and land appreciation.

8. Is agro farming land investment suitable for passive investors?

Yes, agro farming land investment is well suited for individuals who want land ownership without daily farm involvement. Professional management systems handle operations, while owners receive periodic updates and retain full ownership rights.

9. What are the main risks in agro farming land investment?

Risks include weather variability, pest pressure, yield fluctuations, and market price changes. Well-structured agro farming land investment models mitigate these risks through crop diversification, soil regeneration, water management, and transparent reporting.

10. Why is agro farming land investment considered a long-term asset?

Agro farming land investment operates on natural time cycles. Orchards and regenerative farms mature over several years, creating stable productivity and appreciation. This makes it a patient, legacy-oriented asset rather than a speculative one.

I have seen land neglected—and I have seen land transformed.

The difference was never money.

It was intention and management.

Agro farming land investment is not a trend.

It is a return to intelligence.

When land is owned responsibly,

managed professionally,

and respected deeply—

it becomes a lifelong ally.