Delhi Pollution Analysis 2025: The Winter That Warned Us About the Next 10 Years

THE MORNING DELHI COULD NOT BREATHE

On 6 December 2025, Delhi woke up to what looked like another serene winter morning.

Soft sunlight, slightly chilled air, a quiet stillness across the city — the kind of morning we romanticise in stories and postcards.

But Delhi’s winter beauty has learned to hide its wounds well.

Behind that gentle atmosphere was a truth severe enough to shake any city, any leader, any parent, any human:

Delhi recorded a 24-hour average AQI of 333 according to the Central Pollution Control Board.

AQI 333 is officially categorised as “Very Poor”, but the term sounds far softer than the reality.

It means the air carried toxic particulate matter capable of inflaming lungs, entering the bloodstream, and damaging organs.

It means even a healthy adult inhaled the equivalent of several cigarettes worth of pollution without ever picking one up.

It means children — with faster breathing rates and developing organs — took in twice the toxic load.

And yet, the city moved like nothing was wrong.

People drove to work.

Children left for school.

Construction cranes turned.

Joggers ran through what they thought was mist, but was in fact microscopic harm engineered by our own systems.

This is where a real Delhi pollution analysis begins — with honesty, with discomfort, and with a recognition that air pollution is not an air problem at all. It is a land problem, a soil problem, a systems problem, and ultimately, a reflection of how we have built our lives around speed instead of sense.

Let us walk through this story fully — how the crisis began, what is causing it, what the facts truly reveal, and what our next 10 years will look like if we continue this relationship with land and air.

THE DAY DELHI COULD NOT BREATHE — DECEMBER 6, 2025

A meaningful Delhi pollution analysis starts with the numbers because numbers don’t lie, even when people do.

AQI 333 — THE BREAKDOWN

On 6 December 2025:

- 35 of Delhi’s 39 monitoring stations were in the “Very Poor” category.

- Mundka touched AQI 381, nearly tipping into “Severe.”

- “Cleaner” areas like Lodhi Road still recorded AQIs above 300.

This means the entire metropolitan region was blanketed in toxic air.

WHAT AQI 333 MEANS BIOLOGICALLY

AQI 333 typically corresponds to:

- PM2.5 concentrations between 180–250 µg/m³

- WHO safe limit: 15 µg/m³ (24-hour)

Delhi’s air on that day was 20–35 times more toxic than what is medically safe.

PM2.5 is the most dangerous pollutant because:

- It enters the lungs

- Crosses into the bloodstream

- Flows into vital organs

- Triggers inflammation

- Weakens immunity

- Damages heart and brain tissue

This is why The Lancet reports 1.7 million pollution-linked deaths in India every year.

And yet — December 6 felt “normal”.

That is the most alarming phenomenon:

Toxicity is becoming ordinary.

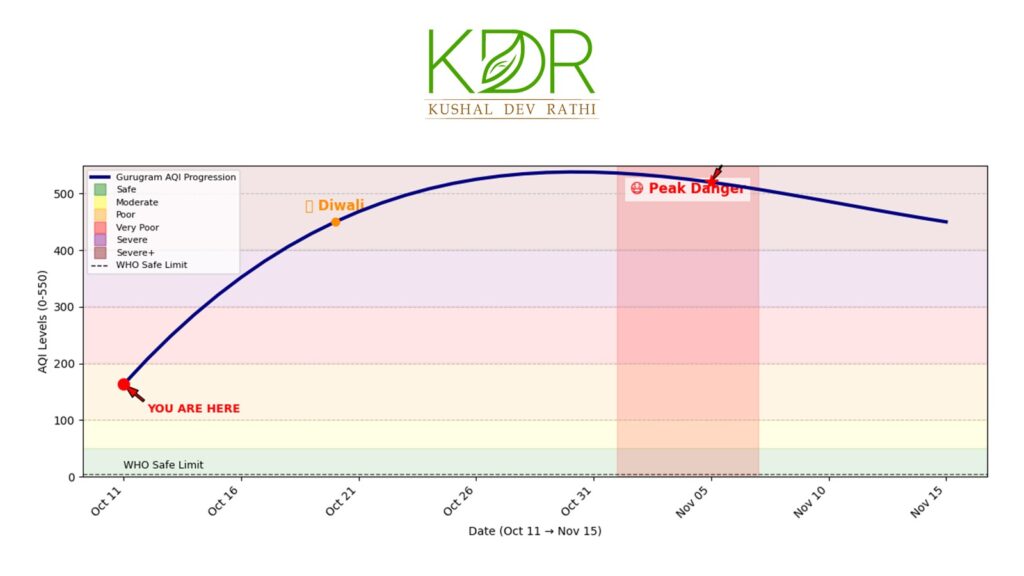

A MORE DANGEROUS STORY — NOVEMBER 2025

December’s air cannot be understood without analysing November 2025, which was a month Delhi essentially lived under an atmospheric emergency.

A comprehensive Delhi pollution analysis of November reveals the following pattern:

MULTIPLE “SEVERE” DAYS

AQI crossed 400+ several times across neighbourhoods.

A “Severe” day means:

- Even healthy people experience respiratory distress

- Outdoor physical activity becomes harmful

- Sensitive groups are at risk of medical emergencies

- Schools often shift online

- Outdoor work becomes hazardous

This severity was not a one-off — it was a pattern.

THE GRAP LOOP: THE CITY’S ANNUAL EMERGENCY MODE

Delhi activated GRAP Stage III multiple times:

- Construction ban

- Diesel genset restrictions

- Road dust management

- Traffic reduction measures

And yet, pollutant levels did not drop significantly.

That’s because GRAP treats symptoms, not causes.

THE CONTRADICTION OF “IMPROVEMENT”

Government officials stated 2025 recorded the best average AQI (Jan–Nov) in eight years.

Statistically true.

Experientially false.

Because people don’t live inside annual averages.

They live inside the days that demand masks, inhalers, anxiety, and fear.

Delhi’s residents did not feel improvement.

They felt suffocation wrapped in silence.

WHAT DELHI IS REALLY BREATHING — THE CHEMICAL COMPOSITION OF WINTER AIR

Air is not emptiness.

Air is a carrier — of dust, chemicals, toxins, metals, and microscopic particles.

A deep Delhi pollution analysis requires understanding what exactly Delhi inhaled in November and December 2025.

Ultrafine particulate matter from:

- Vehicles

- Industry

- Waste burning

- Construction

- Biomass

2. BLACK CARBON

Emitted from diesel exhaust and biomass burning —

It accelerates climate warming and severely damages lungs.

3. NITROGEN OXIDES (NOx)

Produced by combustion engines and industries.

NOx contributes to smog and respiratory disease.

4. SULPHUR DIOXIDE (SO₂)

Mainly from industrial zones around NCR.

5. VOLATILE ORGANIC COMPOUNDS (VOCs)

Released from fuels, paints, solvents —

Combine with sunlight to form ozone, a poisonous gas.

6. HEAVY METALS

Lead, nickel, zinc, manganese — particles that bind to PM2.5 and enter human tissue.

WHY THIS MIXTURE IS DEADLY

Because these elements together:

- Damage lungs

- Alter hormonal balance

- Increase cancer risk

- Impair learning

- Reduce cognitive function

- Trigger heart attacks

- Harm unborn babies

- Shorten lifespan

Air pollution is not a seasonal inconvenience.

It is a public health crisis.

WHERE DELHI’S POLLUTION ACTUALLY COMES FROM — A SYSTEMS FAILURE

This is where most surface-level analysis fails.

A strong Delhi pollution analysis must reveal the deeper structure.

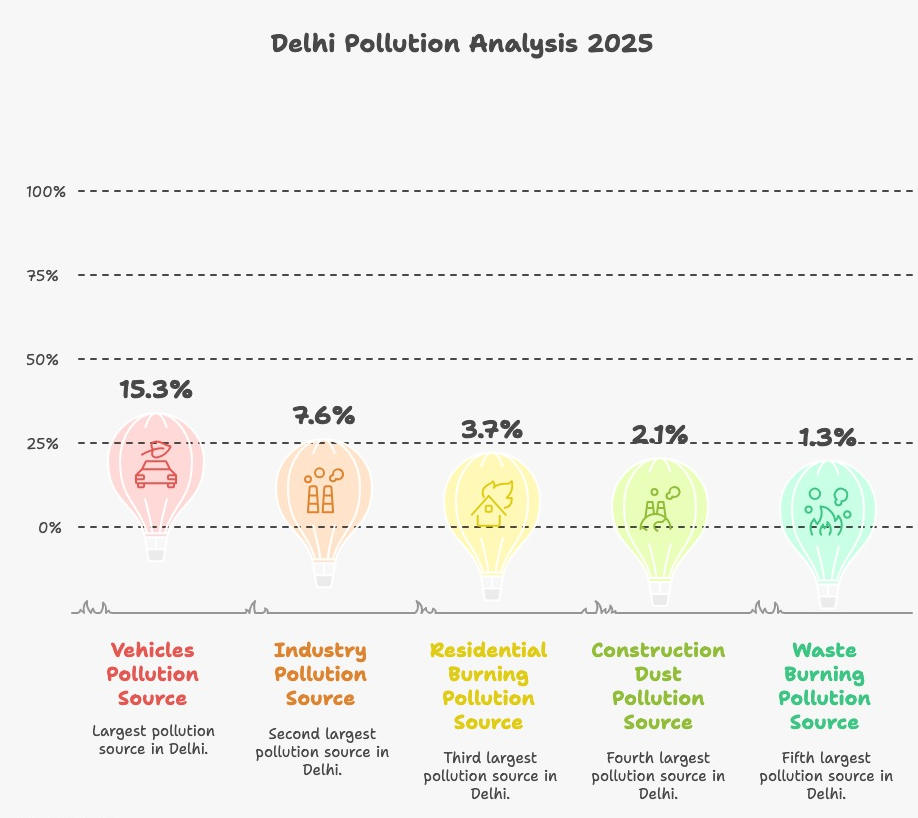

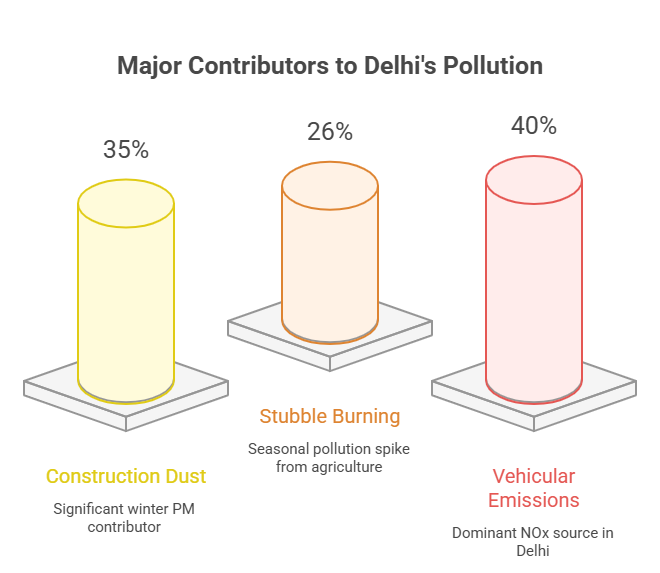

Here are Delhi’s primary pollution sources:

1. Vehicles (~15.3%)

Delhi has one of the highest vehicle densities in India.

Traffic is slow, idling is constant, combustion is inefficient.

Diesel exhaust is a major contributor.

2. Industry (~7.6%)

NCR’s industrial belts emit:

- SO₂

- NOx

- PM2.5

- Toxic gases

Often with outdated technology.

3. Residential Burning (~3.7%)

Lower-income households burning:

- Wood

- Coal

- Biomass

for warmth and cooking.

4. Construction Dust (~2.1%)

Delhi is always building something.

Unregulated construction directly elevates PM10 and PM2.5.

5. Waste Burning (~1.3%)

Despite bans, garbage burning persists in empty plots and landfills.

Plastic burning is especially toxic.

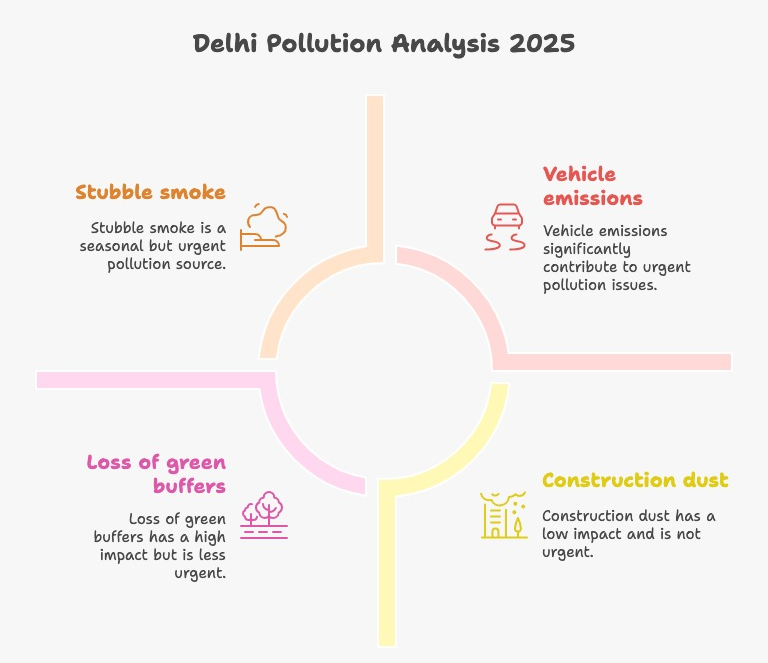

6. Stubble Burning (Seasonal)

A major contributor in late October and early November during specific wind patterns.

7. Delhi’s Geography — A Natural Trap

Delhi is landlocked.

Cool winter air sinks and forms an inversion layer.

Pollutants get trapped.

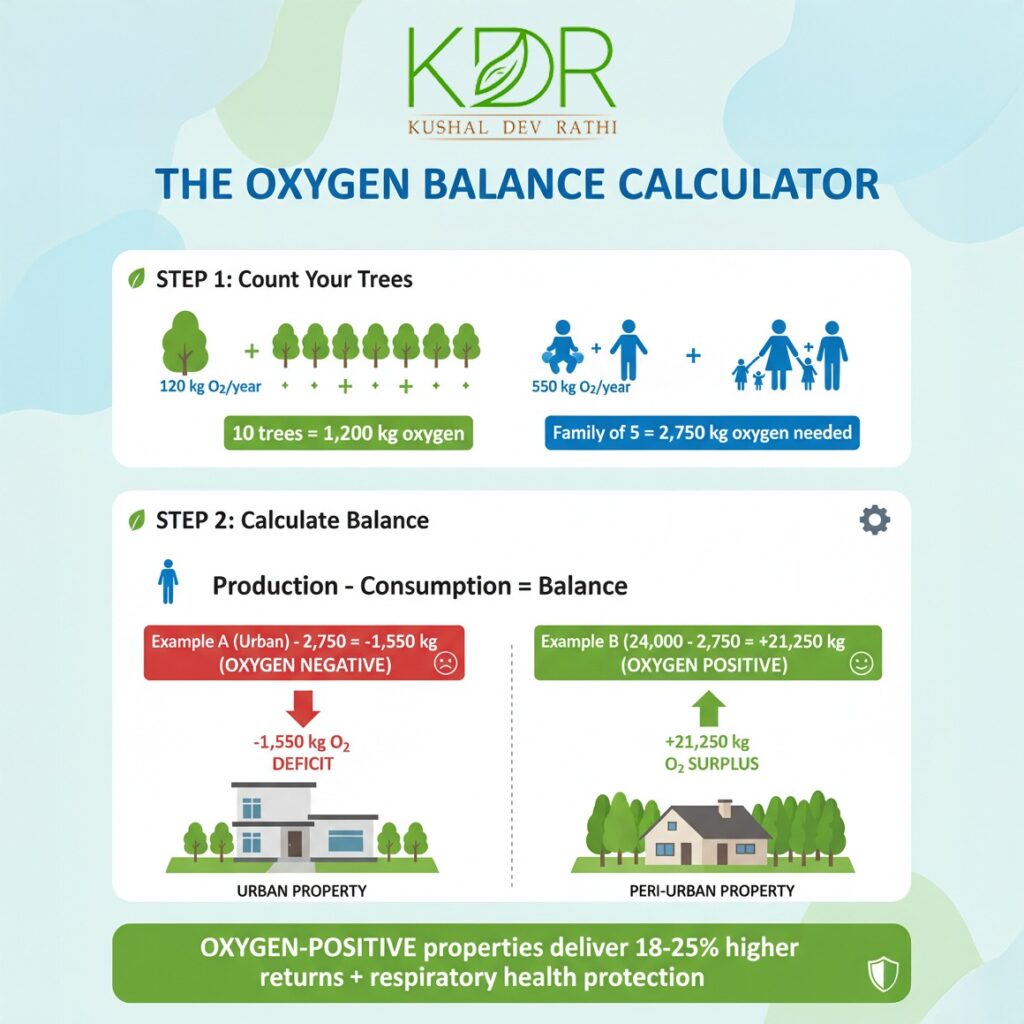

8. Delhi’s Land Mismanagement — The Hidden Cause

This is the real root.

Because air pollution begins long before pollutants rise.

It begins when the land is mismanaged.

Delhi has lost:

- Wetlands

- Floodplains

- Forests

- Green buffers

- Soil moisture

- Biodiversity

As a result:

- Dust rises more easily

- Soil can’t hold particulates

- Trees can’t filter air

- Water bodies can’t regulate humidity

- Heat islands rise

- Air stagnates

Pollution is not a meteorological problem —

it is an ecological degradation problem.

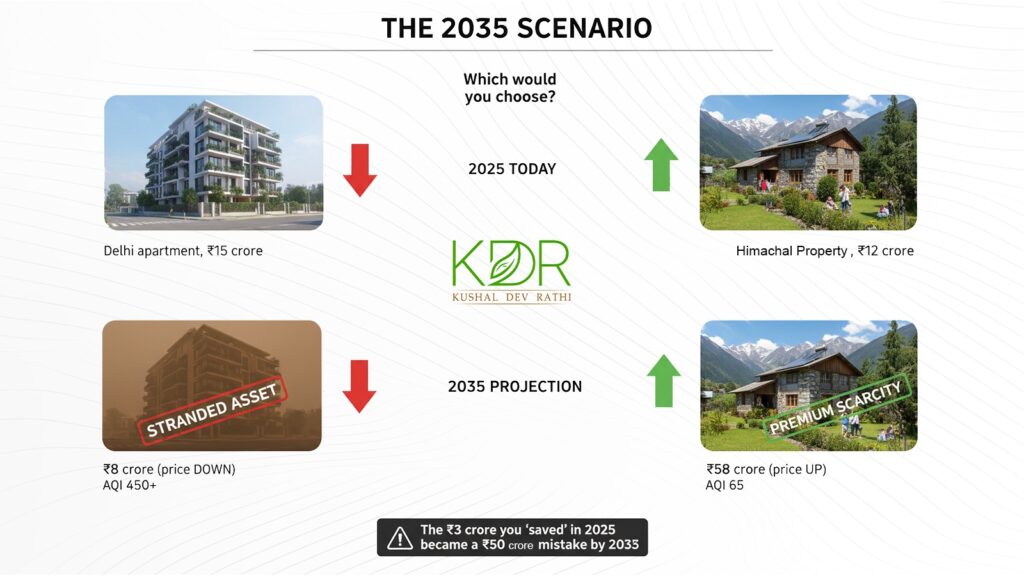

DELHI IN 2035 — TWO FUTURES

This is the heart of the Delhi pollution analysis.

A decade is enough to redefine a city’s identity.

There are two possible Delhis ahead.

THE CITY WE LET CHOKE

1. Winter masks become permanent

A generation grows up thinking this is normal.

2. Hospitals overflow

Respiratory diseases become chronic.

Medical costs rise.

Health inequality widens.

3. Talent migration out of Delhi

People move to cleaner microclimates.

4. Real estate in polluted pockets stagnates

High-value zones lose desirability.

5. Children suffer cognitive decline

Pollution affects brain development.

This is backed by multiple WHO studies.

6. Soil continues to die

Air pollutants deposit heavy metals into soil.

7. Psychological toll

Life becomes anxious, restricted, and health-driven rather than joy-driven.

This is the Delhi we drift toward if we simply “manage pollution” instead of transforming systems.

THE CITY WE REIMAGINE

Now imagine the opposite —

a Delhi that chooses regeneration over crisis response.

1. A transportation revolution

- Electric buses dominate

- Last-mile mobility is electric

- Private vehicles reduce

- Cycling lanes and pedestrian zones expand

2. Land regenerates

Delhi restores:

- Wetlands

- Ridge forests

- Yamuna floodplains

- Urban biodiversity corridors

- Peri-urban agroforestry zones

Land begins to heal — and so does air.

3. Construction becomes dust-free

AI-based monitoring ensures compliance.

4. Health system integrates AQI

Doctors track patient exposure by pin code.

5. Clean-air geographies become wealth zones

People invest in:

- Hills

- Coastal belts

- Forest-edge communities

- Regenerative developments

6. Delhi breathes again

Children play outside.

Winter smells like winter, not chemicals.

The sky is blue more often than grey.

This is not fantasy.

London did it.

Beijing did it.

Mexico City did it.

Delhi can too.

WHY DELHI’S POLLUTION IS A LAND STORY

My core belief remains:

Air is land in motion.

If the land is:

- Sick

- Dry

- Hard

- Eroded

- Treeless

- Toxic

Then the air will be too.

A real Delhi pollution analysis must address:

- Soil health

- Floodplains

- Water cycles

- Green cover

- Biodiversity

- Heat islands

- Ecological systems

Fix the land → fix the air.

Ignore the land → the air will reveal our neglect every winter.

FAQs

1. What does the Delhi pollution analysis for 2025 reveal about the city’s air quality?

The Delhi pollution analysis for 2025 reveals that pollution is no longer a seasonal inconvenience — it has become a structural feature of the city.

December 6, 2025, recorded an AQI of 333, and November saw multiple “Severe” days where AQI crossed 400+. This means Delhi’s air contains toxic levels of PM2.5, NOx, ozone, and black carbon, significantly above WHO safety limits.

The analysis shows that pollution is not an event — it is a symptom of deeper land mismanagement, unregulated construction, vehicular emissions, and the collapse of ecological buffers like rivers, soil, and tree cover.

2. Why is PM2.5 such a major concern in Delhi pollution analysis?

PM2.5 is the most dangerous pollutant because it is small enough to enter the bloodstream.

In Delhi’s winter, PM2.5 concentrations often reach levels 20–35 times higher than the WHO recommended limits.

This results in:

- Chronic respiratory diseases

- Cardiovascular stress

- Cognitive decline

- Impaired lung development in children

- Systemic inflammation in adults

PM2.5 doesn’t just irritate — it alters the body’s internal systems. That’s why every credible Delhi pollution analysis places PM2.5 at the center of concern.

3. What caused the spike in pollution around November–December 2025?

Delhi’s winter pollution spike is a combination of:

- Local emissions — vehicles, industry, construction dust, waste burning

- Seasonal factors — temperature inversion traps pollutants

- Geography — Delhi is landlocked with weak winter winds

- Regional influence — stubble burning from neighboring states

- Ecological degradation — loss of wetlands, soil moisture, and natural wind corridors

When the city loses its natural defenders — soil, trees, water bodies — the air becomes a storage house for pollutants.

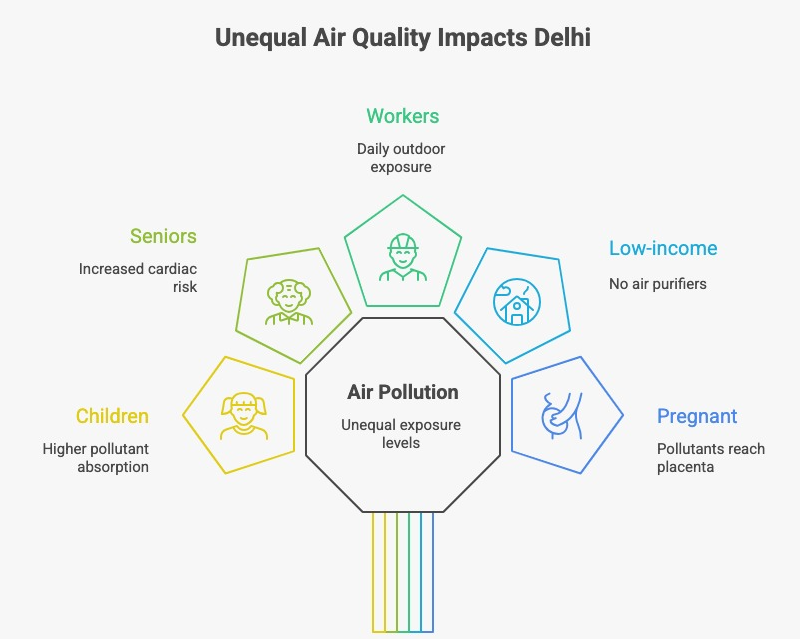

4. How does pollution impact children differently than adults?

Children breathe faster and absorb more pollutants per kilogram of body weight.

Pollution impacts them in ways adults may not immediately see:

- Reduced lung capacity

- Increased asthma and allergies

- Lower cognitive performance

- Memory and attention issues

- Disrupted emotional regulation

- Higher lifetime disease risk

In Delhi, a child breathing winter air is undergoing chronic, involuntary exposure therapy, except the substance is toxic.

5. What role does land mismanagement play in Delhi’s pollution?

A deeper Delhi pollution analysis shows this clearly:

Air pollution begins with the land.

When wetlands are filled, forests shrink, and soil loses its structure:

- Dust increases

- Heat islands expand

- Moisture decreases

- Natural air purification collapses

- Pollutants settle into the city instead of dispersing

The land is Delhi’s first air filter. When the land stops breathing, the city stops breathing too.

6. How does pollution affect the long-term economic and real estate landscape?

Air pollution is reshaping urban economics.

By 2035, if conditions remain unchanged:

- Premium neighbourhoods in polluted zones may see value stagnation

- Families will increasingly migrate to clean-air microclimates

- Investors will prefer land and homes in foothills, coastal regions, and forest-edge communities

- Clean-air zones will become the new luxury real estate corridors

Cities don’t collapse due to pollution — but they lose talent, health, and desirability, which is far more damaging over time.

7. What immediate steps can citizens take to reduce pollution exposure?

Citizens can protect themselves by:

- Tracking daily AQI and adjusting outdoor activity

- Avoiding morning outdoor workouts during winter

- Using masks during high pollution days

- Installing basic indoor air purifiers

- Supporting EV adoption

- Reducing personal vehicle usage

- Planting native tree species around homes

These steps don’t solve the systemic problem, but they reduce individual health risks significantly.

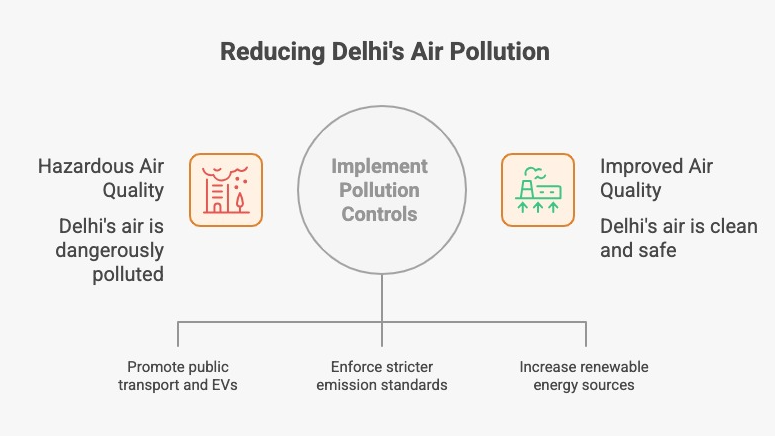

8. What long-term actions must policymakers take to address Delhi’s pollution crisis?

Delhi’s pollution crisis will not be solved by seasonal bans or temporary emergency measures. Policymakers must focus on:

- Electrifying public transport

- Creating dust-free construction ecosystems

- Protecting and expanding wetlands

- Restoring the Yamuna floodplain

- Strictly regulating industrial emissions

- Improving waste management systems

- Designing low-emission neighbourhoods

- Prioritising land regeneration as the first line of defense

This is not a “winter issue” but a year-round systems design challenge.

9. How does climate change influence Delhi’s pollution levels?

Climate change worsens pollution by:

- Increasing heat island intensity

- Reducing wind flow

- Changing rainfall patterns

- Prolonging dry spells

- Strengthening temperature inversions

A warmer, drier city traps pollution longer.

Delhi’s climate trajectory will amplify pollution unless ecological buffers are restored.

10. What will Delhi look like in 2035 if nothing changes?

If the current pattern continues, Delhi in 2035 will likely experience:

- Permanent mask culture

- Higher childhood asthma rates

- Shrinking talent pools

- Increased migration to cleaner states

- Stagnant property values in polluted zones

- Greater economic costs from healthcare

- A generation growing up without outdoor childhoods

But if we choose differently — if we redesign mobility, protect land, restore rivers, and regenerate soil — Delhi can become a city that breathes again.

The choice is not scientific.

It is political, cultural, ecological, and deeply personal.

WHAT WE MUST DO NOW

Citizens

- Track AQI

- Avoid outdoor workouts in winter mornings

- Use masks when needed

- Support EV adoption

- Plant local trees

- Demand better land-use policy

Policymakers

- Strengthen ecological buffers

- Enforce clean construction

- Restore wetlands

- Invest heavily in EV public transport

- Plan climate-resilient neighbourhoods

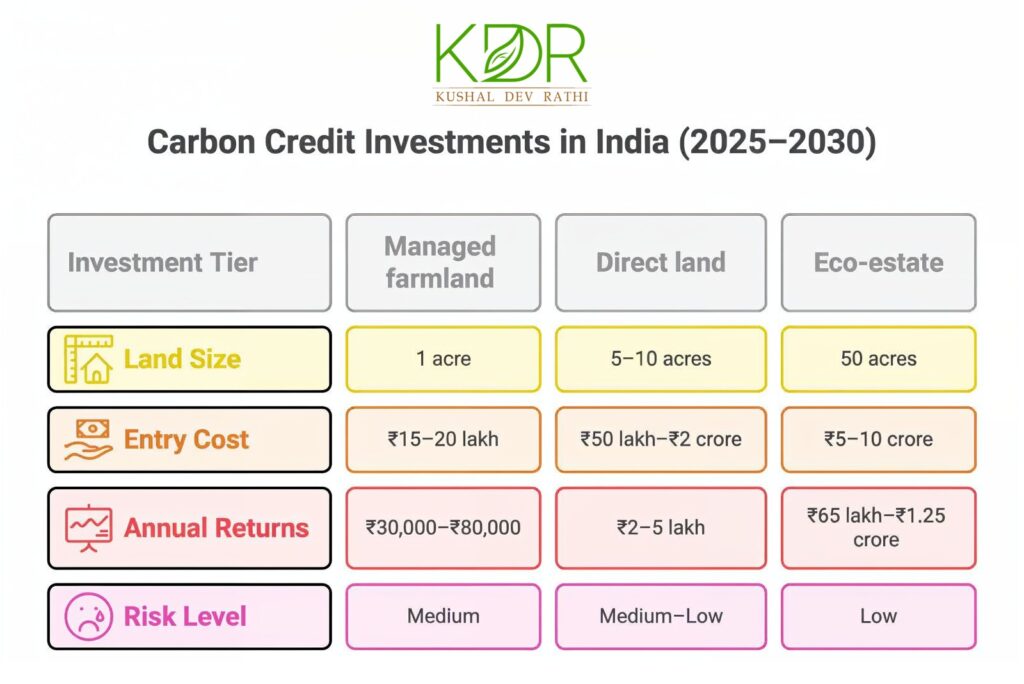

Investors & Land Owners

- Bet on clean-air geographies

- Prioritise regenerative land

- Understand that soil health = property value

- Move beyond hyper-urban density

The future of real estate:

clean air + strong soil + living ecosystems.

THE AIR WE BREATHE TOMORROW IS SHAPED BY THE LAND WE PROTECT TODAY

This Delhi pollution analysis is not only an environmental report.

It is a mirror.

It shows:

- What we have allowed

- What we have ignored

- What we have broken

- What we can still rebuild

Delhi stands at a crossroads.

One path leads to a city that survives.

The other leads to a city that thrives.

A city that chokes.

Or a city that breathes.

A city where children cough.

Or a city where children climb trees and feel the winter sun without fear.

We are writing Delhi’s 2035 story right now —

through every decision about land, water, soil, air, transport, policy, real estate, and design.

What we choose today becomes the air our children breathe tomorrow.

THE HIDDEN COST TABLE

THE HIDDEN COST TABLE

Air Quality Audit: 12-month average via

Air Quality Audit: 12-month average via