Your Electricity Bill Is a Design Decision (And You Can Optimise It)

I have spent over years studying land.

Not just transacting it.

Not just developing it.

Studying it.

How the sun moves across it.

How wind cuts through it in the evening.

How heat settles on a surface at 3:30 PM in May.

Land never lies. Climate never negotiates.

And yet, I see something repeatedly in modern homes — especially premium homes.

People invest in location.

They invest in aesthetics.

They invest in finishes.

But they rarely invest in what will decide their living costs for the next 25 years.

In 2026, that is no longer a small oversight.

Electricity demand is rising.

Heatwaves are intensifying.

Water stress is becoming a seasonal reality across cities.

And still, most homes are built as if energy will remain cheap and the climate will remain predictable.

That is why I believe green building principles that reduce living costs are no longer optional upgrades. They are foundational decisions.

Not for branding.

Not for trend.

For the survival of value.

Let me explain this carefully — the way I would explain it to someone walking with me for the first time.

The Most Expensive Thing in Your Home Is Not EMI. It’s Heat.

In India, particularly in warm and hot climatic zones, the largest recurring cost driver inside a home is cooling.

Air-conditioners are not the problem.

They are the consequence.

When a building absorbs excessive solar heat through its roof and walls, when western glazing is left unshaded, and when ventilation is ignored, cooling systems compensate.

And compensation costs money. Every month.

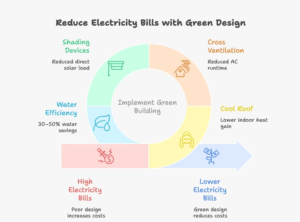

Research and expert commentary on passive cooling consistently highlight that reducing heat gain through design significantly reduces cooling demand. Strategies like shading, cross-ventilation, reflective roofing, and wall optimization are repeatedly recommended as first-line solutions.

This is the first pillar of green building principles that reduce living costs: prevent heat instead of fighting it.

If you reduce heat entry by design:

- AC runtime drops

- Electricity bills reduce

- Appliance wear decreases

- Indoor comfort improves

This is not lifestyle advice.

It is building physics.

And physics compounds quietly over decades.

The Building Envelope: Where Your Monthly Bills Are Decided

When I evaluate a home, I don’t begin with marble.

I begin with the envelope.

The building envelope — roof, walls, windows, glazing — determines how much heat enters and escapes.

The Bureau of Energy Efficiency (BEE) has released the Energy Conservation and Sustainable Building Code (ECSBC 2024), emphasizing the importance of envelope performance in reducing energy demand.

The envelope is not visible in glamour.

But it is visible in your electricity bill.

Cool roofs, reflective coatings, insulation layers, and controlled glazing ratios reduce heat gain significantly — especially in low-rise structures and standalone villas.

When the envelope performs well, mechanical cooling becomes support — not rescue.

This is why I often say:

Technology fights climate.

Design collaborates with it.

And collaboration is cheaper.

That is central to green building principles that reduce living costs.

Passive Design: The Highest ROI in Real Estate

The cheapest decisions in construction are the ones made before the foundation is poured.

Orientation costs nothing.

Ventilation planning costs thought.

Shading design costs awareness.

But the return on these decisions lasts decades.

Peer-reviewed building studies discuss passive cooling approaches such as optimized window placement, cross ventilation, thermal mass utilization, and shading as effective strategies in hot climates.

When I walk the land and for development, I first study wind direction and solar path.

Because if the building breathes naturally, the systems work less.

And when systems work less, costs reduce.

That is how green building principles that reduce living costs begin — before construction.

Cool Roofs: One of the Simplest High-Impact Interventions

In India, roofs endure relentless solar exposure.

Especially in independent homes, villas, and farmhouses — which many of my clients prefer — the roof becomes the primary heat receiver.

Cool roof strategies — using reflective materials or coatings — are widely acknowledged as practical thermal interventions.

When roof heat absorption reduces:

- Indoor temperatures stabilize

- AC dependency drops

- Comfort improves

This is not architectural luxury.

It is cost management.

Among all green building principles that reduce living costs, roof design often delivers one of the fastest returns.

Water Efficiency: The Silent Monthly Stabilizer

Electricity bills are visible.

Water bills often feel secondary — until summer arrives.

The Indian Green Building Council (IGBC) notes that green homes can achieve:

- 20–30% energy savings

- 30–50% water savings

Water-saving measures include:

- Rainwater harvesting

- Low-flow fixtures

- Greywater reuse (where applicable)

- Native landscaping

In water-stressed cities, tanker dependency increases operating costs unpredictably.

Water efficiency is not decorative sustainability.

It is recurring cost control.

This is why green building principles that reduce living costs must include water logic, not just energy logic.

Because operating cost is not one bill.

It is a system of bills.

Standards Matter: Avoiding Superficial Sustainability

In 2026, sustainability is frequently marketed.

But measurable performance matters more than slogans.

India’s ECBC framework (Energy Conservation Building Code) sets energy performance standards for buildings.

The Bureau of Energy Efficiency also operates rating systems for energy performance in buildings.

Standards provide discipline.

Discipline ensures that green building principles that reduce living costs are measurable — not cosmetic.

True sustainability reduces operational expense.

False sustainability increases presentation cost.

Net-Zero and Low-Energy Homes: A Cost Curve Response

Recent reporting highlights growing interest in net-zero and low-energy homes in India, with some estimates suggesting recovery of higher upfront costs within a few years, depending on configuration.

Whether the payback window is 4 years or 7 years depends on variables.

But the larger truth remains:

Energy prices rarely decrease long-term.

Climate stress rarely reduces long-term.

Efficiency therefore, becomes insurance.

This is why I see green building principles that reduce living costs not as luxury upgrades — but as protection against volatility.

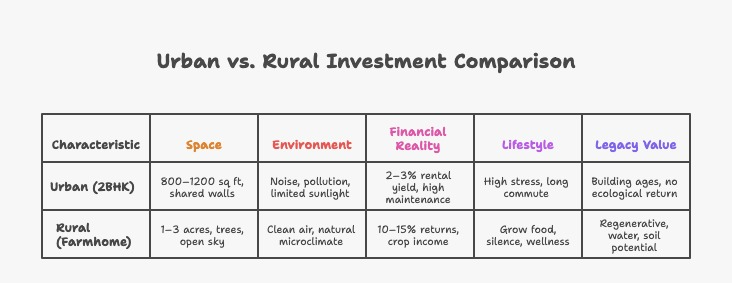

The Order That Actually Makes Financial Sense

If someone asked me today how to prioritize sustainable decisions, I would suggest:

- Orientation and solar path analysis

- Cross ventilation planning

- Roof reflectivity and insulation

- Wall envelope optimization

- Shading devices

- Water harvesting systems

- Renewable energy additions

Most homeowners reverse this order.

They install technology before correcting the design.

And when design is inefficient, technology compensates at a higher cost.

Design discipline is wealth discipline.

And wealth discipline is at the heart of green building principles that reduce living costs.

Why This Matters More in 2026

Heatwaves are intensifying.

Energy demand is rising.

Urban density is increasing.

India’s building codes are evolving to address energy and sustainability challenges.

But regulation alone does not reduce your electricity bill.

Design does.

And homeowners who understand green building principles that reduce living costs today will avoid regret tomorrow.

Regret in real estate is rarely reversible.

What Three Decades in Land Have Taught Me

Land teaches patience.

Buildings teach physics.

If you build against the climate, you pay monthly.

If you build with climate, you benefit monthly.

The philosophy of green building principles that reduce living costs is simple:

Respect the sun.

Respect airflow.

Respect water cycles.

Respect orientation.

And your home will reward you.

I have seen homes where electricity feels manageable even in peak summer — because design did the heavy lifting.

I have also seen homes where ACs run endlessly — because the design ignored the climate.

The difference is not luxury.

The difference is awareness.

FAQ

1. What are green building principles that reduce living costs?

When I speak about green building principles that reduce living costs, I am referring to design strategies that lower monthly electricity, water, and maintenance expenses by aligning the home with climate and efficiency standards.

These include:

- Passive cooling design

- Proper building orientation

- Insulated or reflective roofs

- Efficient water systems

- Optimized building envelopes

The Bureau of Energy Efficiency (BEE) emphasizes envelope performance and energy efficiency in its Energy Conservation and Sustainable Building Code (ECSBC 2024).

These are not luxury features. They are long-term cost stabilizers.

2. How do green building principles actually lower electricity bills?

Electricity bills in India are largely influenced by cooling demand.

When homes are designed using green building principles that reduce living costs, they minimize heat gain. This reduces AC runtime and overall energy consumption.

Passive cooling strategies such as shading, cross ventilation, and reflective roofing are widely recommended for thermal comfort in hot climates.

Lower heat entry = lower cooling demand = lower bills.

It is simple physics.

3. Are green homes more expensive to build?

Some efficiency upgrades may slightly increase upfront cost, especially when incorporating higher-performance materials.

However, reports discussing low-energy and net-zero trends highlight that operational savings can recover additional costs within a few years, depending on design and usage.

The philosophy behind green building principles that reduce living costs is not about initial expense — it is about lifetime economics.

4. What role does the building envelope play in reducing costs?

The building envelope (roof, walls, windows) determines how much heat enters a home.

A poorly designed envelope increases cooling load. A well-designed envelope reduces energy demand.

The ECBC framework outlines energy efficiency standards focused on improving building performance.

Among all green building principles that reduce living costs, envelope optimization is one of the most impactful.

5. How do cool roofs help reduce living expenses?

Cool roofs reflect more sunlight and absorb less heat, reducing indoor temperature rise — especially in top-floor and standalone homes.

This decreases AC runtime and improves comfort.

Passive cooling research and expert commentary frequently highlight reflective roofing as an effective strategy in hot climates.

Cool roofs are one of the simplest green building principles that reduce living costs.

6. Can water-saving systems really make a financial difference?

Yes.

The Indian Green Building Council (IGBC) notes that green homes can achieve:

- 20–30% energy savings

- 30–50% water savings

Water-saving systems such as rainwater harvesting, low-flow fixtures, and efficient landscaping reduce dependency on municipal supply and tanker water.

Water stability is cost stability.

And water management is a key component of green building principles that reduces living costs.

7. Are there official certifications for energy-efficient buildings in India?

Yes.

India has established frameworks such as:

- Energy Conservation Building Code (ECBC)

- BEE Star Rating for Buildings

- IGBC Green Homes Certification

These systems provide measurable standards for energy and sustainability performance.

Certifications ensure that green building principles that reduce living costs are implemented with accountability.

8. Do green homes increase property value?

While value depends on many factors — location, demand, connectivity — energy-efficient and climate-responsive homes are increasingly preferred in the market.

Lower operating costs make properties more attractive to long-term buyers and tenants.

As energy awareness grows, homes designed with green building principles that reduce living costs may offer competitive advantages in future resale scenarios.

Market studies from firms like Knight Frank and JLL often highlight sustainability as an emerging demand driver.

9. Is passive design more important than adding solar panels?

In my experience, yes — at least initially.

Solar panels generate energy.

Passive design reduces energy demand.

If a home is poorly designed thermally, renewable systems compensate inefficiently.

That is why the foundation of green building principles that reduce living costs is climate-responsive architecture — orientation, ventilation, shading — before adding technology.

Energy efficiency first.

Generation second.

10. Why are green building principles more important in 2026?

In 2026, India is experiencing:

- Increased cooling demand

- Rising urban density

- Growing sustainability awareness

- Evolving building efficiency codes

The Energy Conservation and Sustainable Building Code (ECSBC 2024) reflects this shift toward structured efficiency.

Homes built without climate consideration today may face higher operational strain tomorrow.

That is why green building principles that reduce living costs are not about trend adoption.

They are about future-proofing.

The Cost of Ignoring Climate Is Paid Monthly

Over the last thirty years, I have learned something simple — and uncomfortable.

Most financial mistakes in real estate are not made at the time of purchase.

They are made at the time of design.

We negotiate land prices intensely.

We compare localities.

We debate future appreciation.

But we rarely ask:

How much will this house cost me to operate every single month for the next 25 years?

That question is at the heart of green building principles that reduce living costs.

Because a home is not just a structure.

It is a long-term operating system.

And if that system is inefficient, it charges you silently — through electricity, water, and maintenance — year after year.

Climate Is Not an Opinion. It Is Physics.

Heat does not negotiate with marble.

Humidity does not respect premium fittings.

Sun exposure does not care about aesthetics.

India’s building energy frameworks, such as the Energy Conservation and Sustainable Building Code (ECSBC 2024), exist because climate-responsive construction is no longer optional.

These codes emphasize performance — not appearance.

And performance is what determines whether your home works with nature or constantly fights it.

When we ignore passive cooling, shading, ventilation, and envelope design, we are essentially signing up for higher mechanical dependency.

And mechanical dependency is expensive.

That is why green building principles that reduce living costs are fundamentally about alignment — not luxury.

The Quiet Compounding of Design

Compounding is not only a financial concept.

It is a design concept.

If your home reduces energy use by even 20–30%, as indicated by IGBC Green Homes performance benchmarks, that reduction compounds every year.

If your water demand drops by 30–50% through efficient fixtures and harvesting systems, that stability compounds every summer.

Those percentages may look modest.

But across decades, they transform operating cost trajectories.

This is what I call quiet wealth.

And quiet wealth is always built through systems.

The philosophy of green building principles that reduce living costs is not about dramatic savings in a single month.

It is about stability over decades.

Energy demand is increasing.

Urban heat stress is becoming visible.

Awareness around passive cooling and low-energy construction is growing.

Recent discussions around net-zero and low-energy trends in Indian construction highlight the growing recognition that efficient design is financially rational.

The shift toward green building principles that reduce living costs is not driven by fashion.

It is driven by necessity.

And necessity is the strongest driver of long-term market behavior.

When operating costs rise, efficient homes become more attractive.

When climate volatility increases, resilient homes become more valuable.

When regulations tighten, performance-based buildings become future-ready.

Designing for Peace, Not Just Price

There is something deeper here.

When a home is naturally ventilated, shaded correctly, insulated properly, and water-efficient, it does not just reduce bills.

It feels calmer.

Systems strain less.

Appliances last longer.

Maintenance surprises reduce.

A climate-aligned home reduces friction in daily life.

And friction is expensive — emotionally and financially.

That is why green building principles that reduce living costs are not just engineering decisions.

They are lifestyle decisions.

They are legacy decisions.

The Legacy Question

If we are building homes meant to last 30, 40, 50 years, we cannot build them based on yesterday’s climate assumptions.

We must build them based on tomorrow’s realities.

That means:

- Respecting solar path

- Respecting ventilation corridors

- Respecting water cycles

- Respecting envelope performance

- Respecting energy discipline

India’s ECBC framework reinforces performance-based design thinking for the future.

But beyond regulation, the responsibility lies with us.

As developers.

As homeowners.

As investors.

We must understand that green building principles that reduce living costs are about protecting long-term livability.

My Personal Closing Thought

Land has always taught me patience.

Climate has always taught me humility.

And buildings have taught me that ignorance shows up in monthly bills.

A home that fights nature will always be expensive to maintain.

A home that collaborates with nature becomes stable — financially and physically.

In 2026, the shift toward green building principles that reduce living costs is not dramatic.

It is disciplined.

It is intelligent.

And it is inevitable.

The question is not whether this shift will happen.

The question is whether we participate early or pay later.

For me, the answer has always been clear.

Wealth through soil is not just about where you build.

It is about how you build.