Table of Contents

ToggleThe Hidden Pay Raise Every Indian Just Received

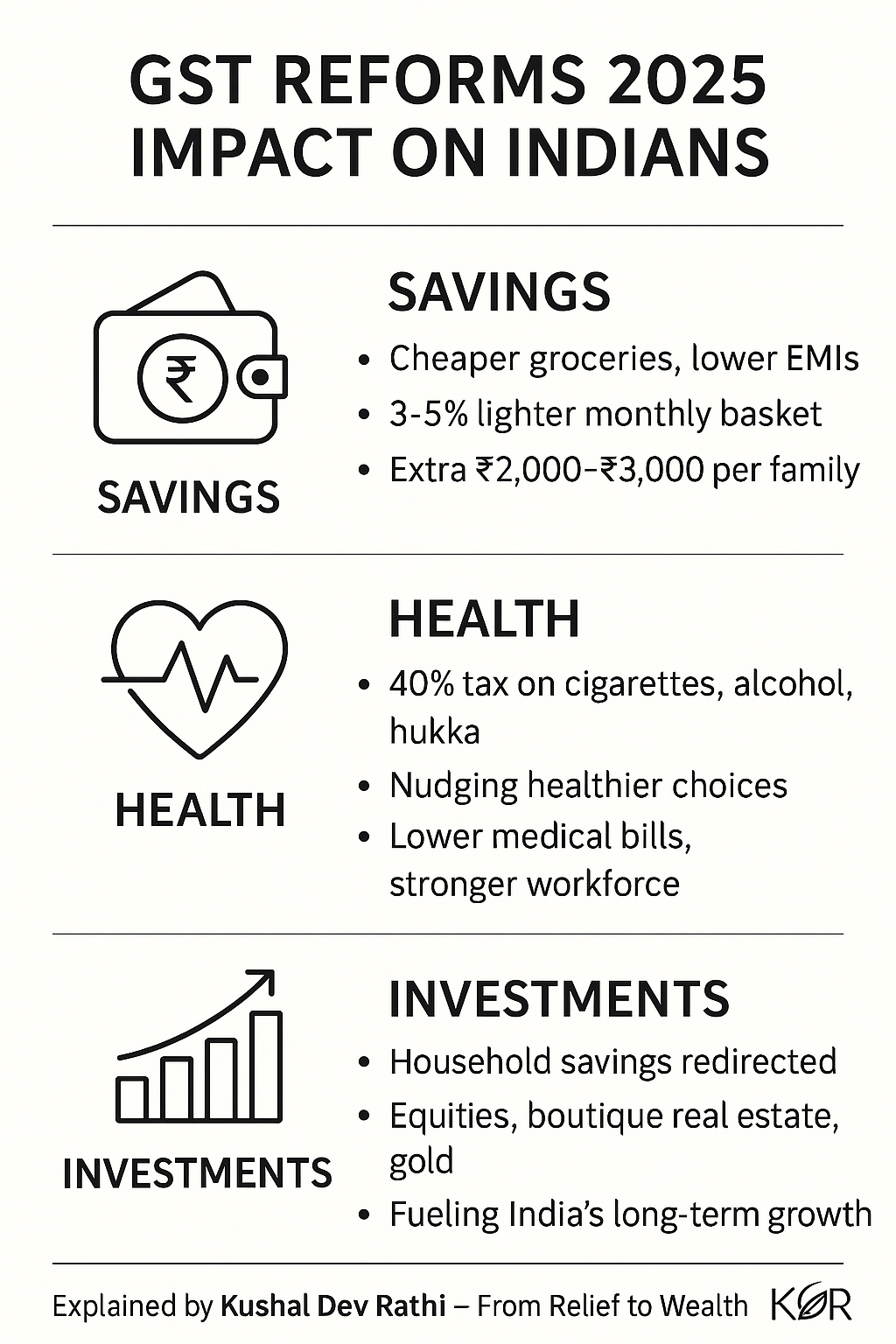

Picture this: the same ₹5,000 grocery basket now costs you 3–5% less. Your EMI feels lighter. Your festive shopping bill doesn’t sting as much.

This is the real, personal impact of GST reforms in 2025. While headlines declare “rates slashed,” what they don’t capture is the direct increase in disposable income for millions of households. The GST reforms of 2025 are having a noticeable impact on Indians, akin to a hidden pay raise — from lighter grocery bills to reduced EMIs and festive relief.

As Kushal Dev Rathi explains:

“GST reforms gave Indians a hidden pay raise. The only question is — will we spend it or invest it?”

GST Rate Cuts 2025 — What It Means for Indians Today

The Goods and Services Tax is no longer new. Eight years since its rollout, GST has become India’s backbone of tax reform. Gross GST collections touched ₹22.08 lakh crore in 2024–25, up 9.4% year-on-year.

Prime Minister Narendra Modi had hailed GST as “a path-breaking legislation for New India.” Today, the proof lies in both revenue and relief:

Businesses benefit → 85% of firms report simplified compliance and lower logistics hurdles.

Consumers benefit → A Finance Ministry study found households save at least 4% on monthly essentials like cereals, oils, sugar, and snacks.

Government benefits → Wider tax base = more fiscal room for development and welfare.

This is a win-win-win reform — and your monthly budget is the first to feel it.

GST and Household Savings — Turning Relief into Wealth

The superficial impact of GST cuts is noticeable: cheaper bills. But the deeper story is how those savings can fuel long-term wealth creation. Another impact of the GST reforms 2025 on Indians is higher disposable income for investments, giving households the chance to turn small savings into long-term wealth.

More Disposable Income → More Savings

With GST cuts, a household saving ₹2,000 each month ends up with ₹3.6 lakh in 10 years, even before investment returns.

Savings → Investments → Growth

According to Kushal Dev Rathi, the most brilliant move is to redirect these “invisible raises” into long-term assets:

Equities (SIPs, ETFs) → to capture India’s market growth.

Boutique luxury real estate → Goa villas, Sariska retreats, Delhi-NCR premium homes.

Gold & bonds → hedging against uncertainty.

Sustainability funds → aligning with India’s green future.

Individual Choices → National Strength

When millions of households channel GST savings into investments, India’s capital pool deepens, fueling infrastructure, business expansion, and jobs. What starts as relief on your bills ends as a stronger national economy.

As Kushal Dev Rathi frames it:

“Reforms open doors. But it takes discipline to walk through them. If Indians turn GST savings into financial assets, we secure both personal and national wealth.”

GST and Health — Why Cigarettes & Alcohol Got Costlier

GST reforms are not just about money — they’re also about nudging lifestyle choices. A social GST reform in 2025 is expected to have a positive impact on Indians, leading to healthier lifestyle choices, as higher taxes on cigarettes, alcohol, and hukka discourage harmful spending.

By placing 40% taxes on cigarettes, alcohol, and hukka, the government is making unhealthy lifestyles more expensive. This is behavioural economics at work.

The results are visible:

Between 2016 and 2021, the share of men who consumed alcohol dropped from 29.2% to 17.5%, and tobacco use fell from 44.5% to 32.6%.

As Kushal Dev Rathi puts it:

“Just like mothers hold our ears and force us to eat vegetables, the government has taken on the role of a strict parent. We refused to listen earlier — higher taxes ensure we are listening now.”

This “tough love” approach not only saves lives but also reduces medical costs, thereby freeing more savings for productive use.

Healthcare Spending — Lower Bills, Healthier India

The Economic Survey 2024–25 highlights a major social shift:

Government health expenditure rose from 29% in FY2015 to 48% in FY2022.

Out-of-pocket medical costs fell from 62.6% to 39.4%.

Ayushman Bharat (AB-PMJAY) has saved households over ₹1.25 lakh crore so far.

For families, this means fewer medical shocks that erode wealth. As Kushal Dev Rathi notes:

“Lower medical bills aren’t just about healthcare. They translate into higher household savings — which can power investments, education, and security.”

This is why GST reforms are about more than consumption relief — they align with India’s vision of building a healthier, financially stronger nation.

GST Reforms 2025 Impact on Indians’ Household Savings

Despite reforms, there’s a warning light: India’s household savings rate dropped to 30% of GDP in 2022–23, the lowest in four decades.

Why Savings Fell

Pandemic disruptions forced families to dip into reserves.

Inflation eroded purchasing power.

A cultural shift toward YOLO consumption.

Why It Matters

Thinner safety nets for families.

Less domestic capital for infrastructure.

More vulnerability to shocks.

The Turnaround Plan

Union Budget 2025–26: No tax on annual income up to ₹12 lakh, freeing liquidity for middle-class households.

Financialisation push: SIPs, NPS, sovereign bonds, and small savings schemes are gaining traction.

Goldman Sachs projection: Indian households will generate $9.5 trillion in new financial assets over the next decade.

For Kushal Dev Rathi, this is the moment of discipline:

“The challenge isn’t lack of money. It’s lack of discipline. GST reforms give us the cushion — now we must convert that into compounding wealth.”

India vs USA — Why Timing of Reforms Matters

The global context makes GST reforms even more significant.

USA: battling inflation, debt, and slowing growth.

India: cutting taxes, attracting global investors, boosting domestic demand.

As Kushal Dev Rathi explains:

“Uncle Sam may be losing his punch, but the golden bird is spreading its wings. The eagle is rising in the East — and every Indian is part of that rise.”

For global investors, this makes India the preferred growth engine of the 2030s.

Action Plan — How to Invest GST Savings

Don’t let your “hidden pay raise” slip away. Here’s a 3-step plan:

Step 1: Calculate Your Relief

Even ₹2,000/month saved = ₹24,000/year = ₹4.8 lakhs in 20 years (without returns).

Step 2: Allocate With Intention

30% → Equities (SIPs, ETFs)

30% → Boutique luxury real estate

20% → Gold / sovereign bonds

20% → Sustainability & innovation funds

Step 3: Stay Consistent

Wealth isn’t built by windfalls but by compounding discipline over decades.

FAQs on GST Reforms and Their Impact

Q1. How do GST reforms affect the commoner?

They lower costs on essentials, freeing money for savings and investments.

Q2. Can small GST savings really build wealth?

Yes. Even ₹2,000/month invested in SIPs for 20 years can grow into ₹25–30 lakhs.

Q3. Why did the government raise taxes on cigarettes and alcohol?

To encourage healthier lifestyles, reduce medical costs, and boost productivity.

Q4. How do GST reforms strengthen India’s economy?

By boosting compliance, expanding formalisation, and deepening domestic savings.

Q5. Why is this timing critical compared to the USA?

India’s reforms coincide with America’s slowdown, positioning India as the next global growth hub.

Q6. What should middle-class Indians do with GST savings?

Treat them as seed capital — split between equities, real estate, gold, and sustainable investments.

Closing Perspective from Kushal Dev Rathi –

The GST reforms 2025 impact on Indians goes beyond immediate relief — it is reshaping habits, savings, and the nation’s growth story.

“GST reforms gave Indians more than financial relief. They gave us a chance to transform our habits, our savings, and our nation’s future. Most will spend it. The wise will invest it. The future will belong to the latter.”

For more thought-provoking articles :