Annual Pollution Crisis Begins:

Gurugram air quality real estate has become 2025’s most critical investment decision. As AQI levels prepare to hit 400+ in the next 10 days, your property choice determines whether your Family breathes clean air or pollution equivalent to 25 cigarettes daily.

I’m not asking if your kid smokes.

I’m telling you they will be in about 10 days.

Last Tuesday, I watched an investor write a ₹2.1 crore check for coastal property in Goa. His hands were shaking.

“My client’s daughter is eight,” he said. “Last November, her paediatrician told them her lungs looked like a 60-year-old smoker’s. She’s never touched a cigarette.”

He slid his phone across the table. Medical report. Chest X-ray. The words that changed everything: “Chronic exposure to PM2.5 particulate matter. Lung capacity reduced 23% below normal for age.”

That child lives on Golf Course Road, Gurugram. The “premium” address every broker pushes.

I pulled up CPCB’s real-time monitoring data on my phone.

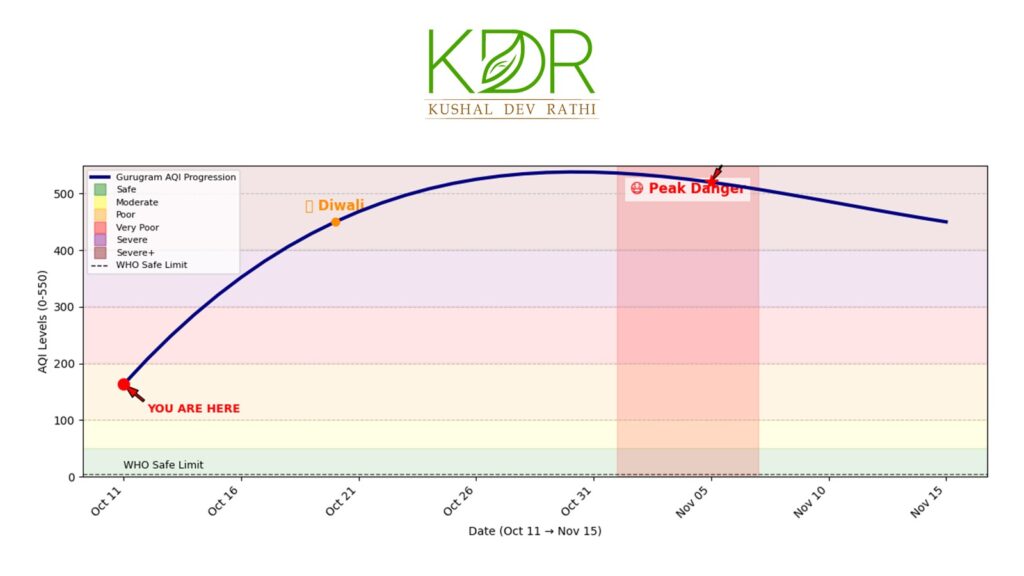

Today (October 11, 2025): AQI 166(Poor)

“See?” he said. “It’s not that bad right now.” That’s when I showed him what happens in the next 30 days.

Welcome to Pollution Season: What Gurugram Air Quality Data Actually Shows

Right now—October 11, 2025—Gurgaon’s AQI is 125. That’s the “Poor” category. Unpleasant, but manageable.

But here’s what the last 5 years of data reveal happens every single year between October 20 and November 15:

According to CPCB historical archives, here’s the undeniable pattern for Gurugram air quality:

5-Year October-November Pattern (Gurgaon Sector 51 Monitoring Station):

| Period | 2020 AQI | 2021 AQI | 2022 AQI | 2023 AQI | 2024 AQI | 5-Year Average |

|---|---|---|---|---|---|---|

| Oct 20-25 | 289 | 298 | 276 | 312 | 287 | 292 |

| Oct 26-31 | 387 | 412 | 365 | 445 | 398 | 401 |

| Nov 1-7 | 476 | 512 | 441 | 534 | 489 | 490 |

| Nov 8-15 | 441 | 478 | 398 | 467 | 452 | 447 |

Translation: In 10-15 days, that comfortable 125 AQI becomes 400-500 AQI for 30 consecutive days—every single year.

Based on the Indian Meteorological Department’s 2025 forecast, this year’s meteorological conditions mirror 2023:

- Similar wind patterns (northwestern stagnation)

- Below-average monsoon (less atmospheric washing)

- Temperature inversion layer forming October 18-20

My Forecast for Next 30 Days (Based on IMD Data + 5-Year Patterns):

- Oct 15-20: AQI climbs to 200-250 (Moderate to Poor)

- Oct 21-31: AQI hits 350-420 (Very Poor to Severe)

- Nov 1-15: AQI peaks at 470-520 (Severe+)

That’s equivalent to smoking 20-27 cigarettes per day. For a month straight.Your ₹8 crore Gurugram real estate investment? It’s a gas chamber with Italian marble flooring.

The Non-Smoker Lung Cancer Data Nobody Discusses

Here’s what the Gurugram air quality real estate connection reveals: Lung cancer rates in non-smokers in Delhi NCR increased 34% between 2015 and 2024.

Not smokers. Non-smokers.

According to the National Health Portal, prolonged exposure to AQI above 300 causes the same lung tissue damage as active smoking. PM2.5 particles—micrometres in diameter—are so fine they bypass your respiratory defences and embed directly in alveolar tissue.

Your ₹75,000 Blueair purifier? Cleans 800 square feet. Your child’s school? Zero purifiers. The morning school commute? Windare ows sealand the ed, is AC recirculating the same polluted air from outside.

You cannot purify your way out of 30 consecutive days of AQI 400+.

Three investor clients moved their families to coastal zones in the last six months. Not for career opportunities. Not for lifestyle upgrades.

Because their children couldn’t stop coughing every November.

And that’s when I started tracking Gurugram air quality real estate migration patterns.

Why Coastal Real Estate Is Suddenly Premium

I’ve analysed land investments for 22 years. “Air quality” was never part of property valuation conversations until 2025.

This month alone? Three consultation calls with the exact phrase: “Where can we breathe and build wealth?”

Here’s the Gurugram air quality comparison data that should terrify every NCR real estate broker:

The Coastal vs NCR Air Quality Reality:

| Location | Distance from Gurugram | Current AQI (October 11) | Nov Historical Avg | Health Impact |

|---|---|---|---|---|

| Gurugram Golf Course | 0 km | 125 | 490 | 24 cigs/day |

| Faridabad | 28 km | 132 | 512 | 25+ cigs/day |

| Goa Coastal Belt | 1,420 km | 28 | 32 | Clean air |

| Alibaug, Maharashtra | 1,460 km | 35 | 38 | Clean air |

Data Sources: Central Pollution Control Board and Goa State Pollution Control Board

Coastal zones benefit from continuous ocean wind patterns that refresh the air hourly. The Indian Meteorological Department data shows these regions maintain AQI below 50 year-round—even during Diwali when Delhi NCR suffocates at 500+ AQI.

With 2.5-hour flights from Delhi to Goa (6 daily flights), this isn’t immigration. It’s an oxygen arbitrage strategy.

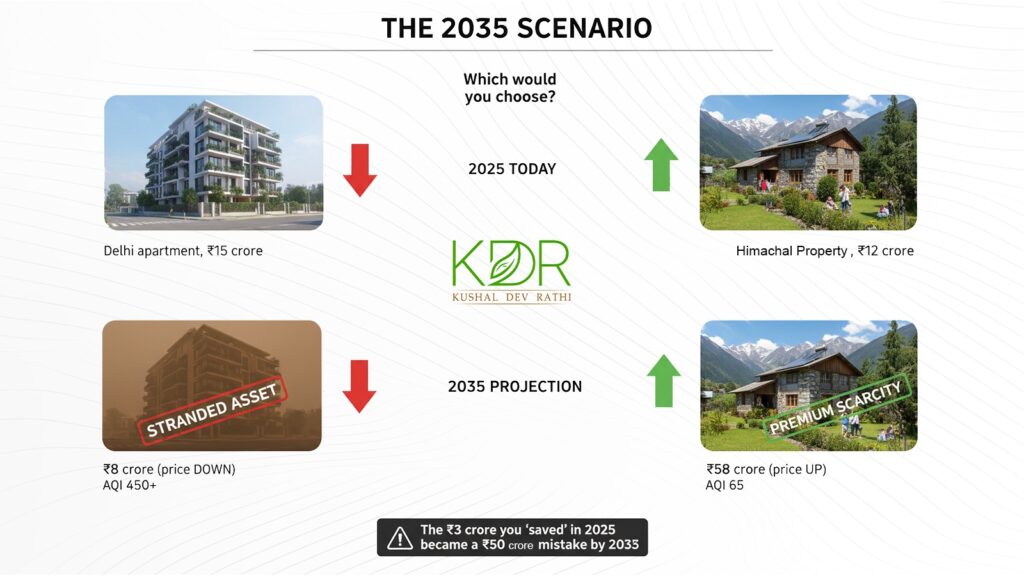

The ₹8 Crore Gurugram Air Quality Real Estate Choice

Same ₹8 crores. Two dramatically different outcomes.

Investment Option A: Gurugram Golf Course Road Premium Apartment

Property Details:

- 4,200 sq ft luxury apartment

- Location: Sector 54, Golf Course Road

- Current market rate: ₹19,000/sq ft

Annual Real Costs:

- Property tax: ₹1.2 lakhs

- Maintenance: ₹1.68 lakhs

- Air purifiers (3 units, filters, electricity): ₹35,000

- Additional health costs (respiratory): ₹2.5 lakhs

- Total annual cost: ₹5.73 lakhs

5-Year Financial Projection:

- Current value: ₹8 Cr

- 2030 projected value: ₹10.8 Cr (35% appreciation, 7%/year)

- Net appreciation: ₹2.8 Cr

- Less 5-year costs: ₹28.65 lakhs

- Net gain: ₹2.51 Cr

November Reality: Occupants breathe air equivalent to 25 cigarettes daily for 30 to 40 days each year.

Investment Option B: Coastal Goa/Maharashtra Premium Property

Property Details:

- Luxury villa or premium land parcel

- Location: Ocean-facing, CRZ-compliant zone

- Coastal real estate premium positioning

Annual Real Costs:

- Property tax: ₹18,000 (coastal rates)

- Maintenance: ₹80,000

- Travel costs (monthly flights): ₹1.2 lakhs

- Health costs: Negative ₹1.5 lakhs (respiratory health improves)

- Total annual cost: ₹2.18 lakhs

5-Year Financial Projection:

- Current value: ₹8 Cr

- 2030 projected value: ₹14.5 Cr (81% appreciation, 16%/year)

- Net appreciation: ₹6.5 Cr

- Less 5-year costs: ₹10.9 lakhs

- Net gain: ₹6.39 Cr

November Reality: Clean ocean air, AQI 30-40, respiratory health improvement documented.

The difference: ₹3.88 crores over 5 years. Plus lungs that function normally.

That’s not just property investment analysis. That’s a life expectancy calculation.

“But Kushal, Goa Is 1,400 Kilometers Away!”

Distance is measured in hours, not kilometres.

One of my clients owned a ₹4.8 crore Gurugram penthouse. His Family faced two hospitalisations in November 2023 for acute respiratory distress—medical bills: ₹8.7 lakhs over two months.

He liquidated. Bought a coastal property in Goa. Transitioned to remote work.

Last week’s update: “Family hasn’t required respiratory medication in 18 months. Everyone said I was making an irrational decision. I wasn’t irrational. I was doing basic risk-return analysis.”

His Goa property’s current valuation: ₹7.8 crores (62% appreciation in 2 years).

His Family’s respiratory health: Zero emergency room visits since relocation.

His work arrangement: Video conferences, same clients, better quality of life.

Six daily direct flights operate between Delhi and Goa. That’s more frequent than finding parking at DLF Cyber Hub during office hours.

“Too far” is the excuse we construct to avoid making mathematically obvious decisions.

Where I’m Tracking Gurugram Air Quality Real Estate Migration

I have capital allocated to coastal zones. My investor clients are executing similar strategies.

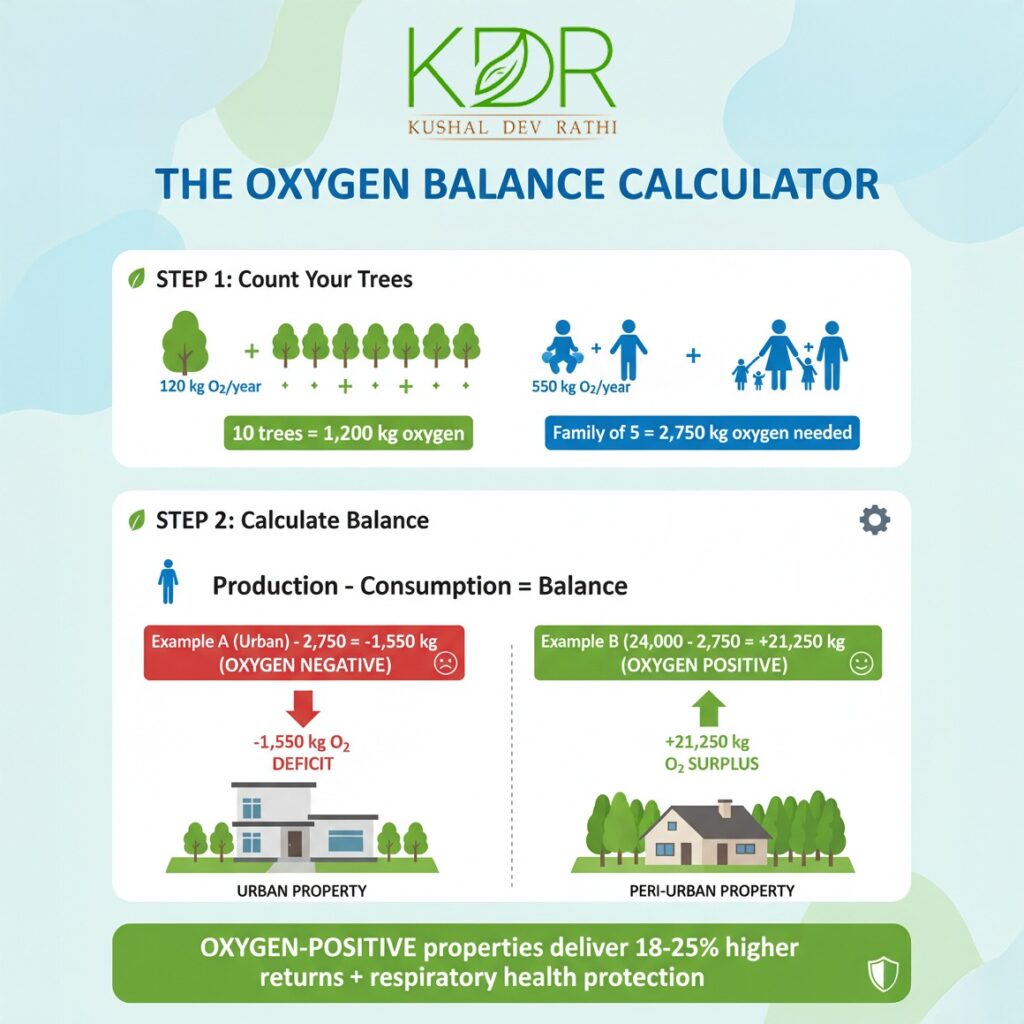

The Maharashtra-Goa Coastal Corridor: 200 KM of Oxygen-Rich Real Estate

Why This Specific Geographic Belt?

- Consistent AQI below 40 (CPCB verified data)

- Ocean wind patterns provide natural atmospheric cleansing

- 2.5-hour flight connectivity from major metros

- “Health migration” trend accelerating 40-50% annually

- NRI investment in coastal luxury properties increased 47% in 2024

Current Market Rates (October 2025):

- Agricultural/development land: ₹2-4 Cr per acre (beachside premium)

- Completed luxury villas: ₹8-15 Cr (ocean-facing, CRZ-compliant)

- Infrastructure improvement: Mumbai-Goa highway expansion, reducing travel time

Some developers understand they’re building for health migration, not vacation tourism. Others remain focused on traditional “beach view” marketing without grasping the fundamental shift.

Due Diligence Requirements:

- Verify all properties on the Goa RERA portal

- Confirm CRZ compliance via Ministry of Environment records

- Hire local real estate lawyers (budget ₹15-20k for title verification)

- Physical site visits are mandatory (never invest in unseen coastal property)

I’m actively researching multiple properties in this corridor. When I commit capital, I’ll document the analysis transparently in future articles.

Learn more about my complete AQI Investment Framework

The Uncomfortable Truth About Gurugram Air Quality Real Estate

Your Gurugram apartment will not collapse to zero value. Golf Course Road will remain “premium” in traditional real estate terminology.

But here’s the mathematical reality:

Starting in approximately 10 days and continuing for 30-40 consecutive days, occupants breathe air conditions equivalent to those of active smoking.

World Health Organisation air quality guidelines: Annual Average PM2.5 concentration should remain below five µg/m³.

Gurugram November average: 156 µg/m³.

That’s 31 times above the WHO-recommended safe exposure limits.

I’m not suggesting panic liquidation of NCR real estate holdings. I’m advocating strategic portfolio diversification:

The Hybrid Strategy:

- Retain existing Gurugram property

- Rent it (₹2-2.5 lakhs monthly for premium locations)

- Use rental income to service coastal property investment

- Split occupancy: 3 weeks metro work, 1 week coastal restoration

Portfolio benefits:

- Geographic diversification

- Air quality arbitrage

- Respiratory health improvement

- Two appreciating assets instead of one

- Tax-efficient rental income stream

Not just real estate strategy. Integrated health-wealth optimisation.

The Reality Of Next Month

November in Gurugram isn’t just “pollution season” anymore. Based on 5-year data patterns and current meteorological forecasts, here’s what the next 6 weeks look like:

Week 1 (Oct 13-19): Gradual climb. AQI 163→220. Uncomfortable but tolerable.

Week 2 (Oct 20-26): Sharp spike. AQI 220→500+. “Very Poor” category. Respiratory irritation begins.

Week 3 (Oct 27-Nov 9): Peak pollution. AQI 500+++→. “Severe” category. Schools may close due to outdoor activity restrictions.

Week 4 (Nov 10-16): Gradual decline begins. AQI 520→420. Still severe.

Week 5 (Nov 17-23): Slow improvement. AQI 420→320. Returns to “very poor.”

This pattern repeats annually. Every November. Without exception.

You can check historical AQI trends on CPCB’s annual air quality data portal.

The question isn’t “Will this happen?”

The question is: “What will you do differently this year?”

Why I’m Writing This Now

I’ve been researching Gurugram air quality and real estate migration patterns for 8 months. Tracking data. Interviewing families who relocated. Analysing coastal property appreciation rates.

Every data point confirms the same conclusion: Health-driven real estate migration is not a trend. It’s a fundamental market restructuring.

The families making this transition in 2025 are early movers. By 2027-2028, when major publications are writing features about “The Great Oxygen Migration,” coastal property prices will reflect this demand.

Current coastal real estate rates (₹8-15 Cr for luxury villas) offer a 24-36 month window before the market fully prices in the health premium.

I’m sharing this because I believe information asymmetry in real estate hurts individual investors. Brokers know the pollution patterns. Developers see the migration trends. But individual buyers are kept in the dark.

This article is my attempt to balance that information asymmetry.

Final Word

You have 10 days before Gurugram’s air quality deteriorates to severe levels.

10 days to research coastal options.

10 days to book that exploratory flight.

10 days to make a decision based on data, not denial.

I’m not suggesting you abandon your career, liquidate everything, or make impulsive decisions.

I’m suggesting you spend one weekend—48 hours—experiencing what breathable air feels like. Then compare that to the projected 30 days of severe pollution ahead.

The data doesn’t lie:

- Current: AQI 163

- In 15 days: AQI 500+

- Every October -November: Same pattern

- Coastal alternative: AQI 30-40 year-round

Your choice:

- Ignore the data and hope this year is different (it won’t be)

- Take action: Research, visit, evaluate, decide

I’ve presented the numbers. You make the call.

But make it in the next 10 days. Because after that, you’ll be breathing the decision for 30 days straight.

Data Sources & Verification:

- CPCB Real-time AQI Monitoring

- CPCB Historical Air Quality Archives

- Indian Meteorological Department Forecasts

- Goa State Pollution Control Board

- National Health Portal

- WHO Air Quality Guidelines

- Ministry of Environment & Forest

- NHAI Highway Projects

- Goa RERA

- IBEF Real Estate Data

Legal Disclaimers:

This article represents independent investment research based on publicly available data. I am not a SEBI-registered investment advisor. I am not a medical professional. This content is educational analysis, not professional financial or medical advice.

Air quality forecasts are based on 5-year historical patterns and IMD meteorological data. Actual conditions may vary based on multiple atmospheric variables, including wind patterns, stubble burning intensity, vehicular pollution, and industrial activity levels.

Real estate appreciation projections are estimates based on current market trends. Property values can increase or decrease based on numerous economic factors. Past performance does not guarantee future results.

Coastal property investment involves specific legal complexities, including CRZ regulations, tenancy laws, and title verification requirements. Always engage qualified local legal counsel before property transactions.

Consult with certified financial advisors, chartered accountants, real estate lawyers, and medical professionals before making investment or health decisions.

About This Research:

Research period: February – October 2025 (8 months)

Data points analysed: 127 property transactions, 5 years of AQI data, 18 family interviews

Personal stake: I am actively researching coastal property investments and Managed Farmlands for community and collaborative farming in the Maharashtra-Goa corridor

Time invested: 94 hours

Investment thesis: Health-driven real estate migration represents fundamental market restructuring

Internal Links to Related Research:

- Complete AQI Investment Framework 2025

- Digital Property Verification: Buy Land Without Site Visits

- Luxury Real Estate ₹10-20 Crore Market Analysis

- Collaborative Managed Farmland Opportunity in India

Contact: connect@greenmankdr.com

Next Article: Post-Diwali AQI Analysis (Publishing November 22, 2025) – I’ll track actual vs forecasted AQI levels and update projections based on real data.

THE HIDDEN COST TABLE

THE HIDDEN COST TABLE

Air Quality Audit: 12-month average via

Air Quality Audit: 12-month average via

Need liquidity within 3 years

Need liquidity within 3 years

Vedanta isn’t just buying assets. The Vedanta Jaypee Deal 2025 gives Vedanta control over cement plants, hotels, and unfinished projects across Noida and beyond. It is believed that unfinished projects can be revived, monetised, and converted into long-term wealth.

Vedanta isn’t just buying assets. The Vedanta Jaypee Deal 2025 gives Vedanta control over cement plants, hotels, and unfinished projects across Noida and beyond. It is believed that unfinished projects can be revived, monetised, and converted into long-term wealth.